Check fraud: How a seemingly vintage payment method is the center of a trending fraud scheme

Nov 14, 2024

As technology evolves, so does fraud… right? The last five years have revealed new schemes and new ways to make those schemes a bit easier with the widespread use of artificial intelligence (AI), deepfake technology and even generative AI sites with chatbots ready to help would-be fraudsters with their schemes.

With all this technology at hand, anti-fraud professionals have been surprised at the dramatic rise in a less-sophisticated scheme: external check fraud.

Defining external check fraud

These schemes can take multiple forms, but usually begin with a bad actor intercepting an organization’s check through mail theft. The bad actor may simply deposit the check in their own account or will “wash” the check using chemicals such as nail polish remover to remove the payee, amount or other information.

Once washed, the bad actor can either replace the payee and amount with whatever information they want and deposit it into their account, or they can sell an image of the washed check on the dark web for others to use. Some governments have reported that after a particular check was seemingly stolen through the mail, they saw multiple versions of that same check number try to clear their bank – all for different dollar amounts and to different payees.

In other cases, the bad actor needs only the banking and routing information printed on the check for their scheme. They can use that information to create counterfeit checks with the payor’s information or create electronic checks to pay expenses online.

A rise in check fraud schemes

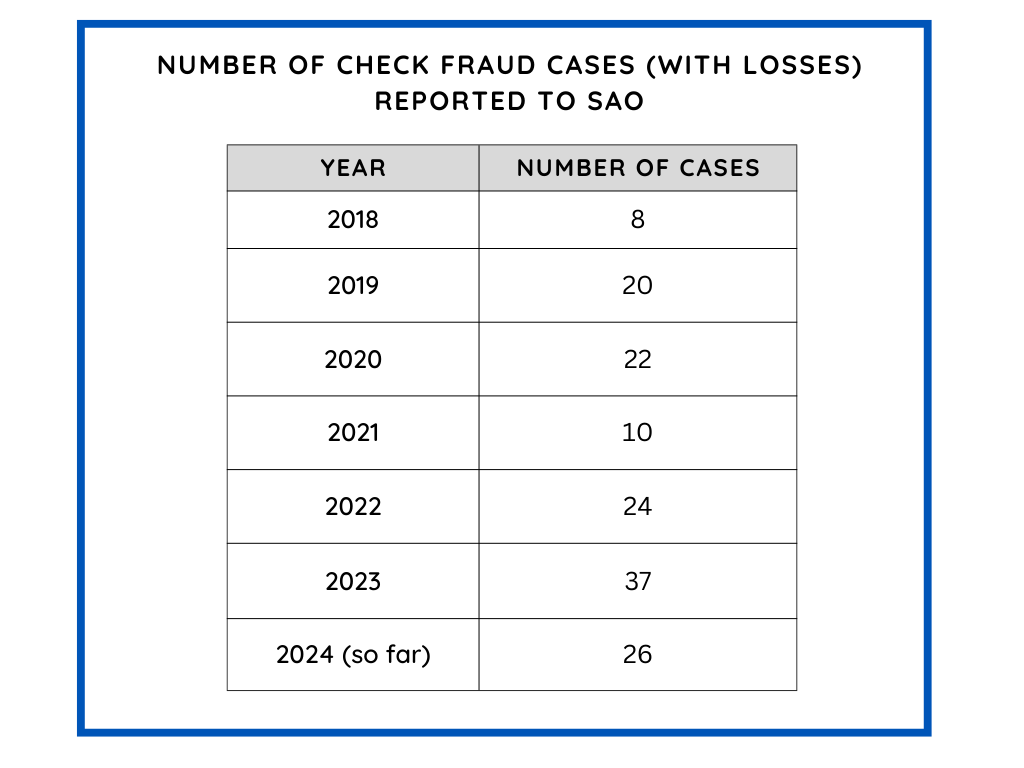

Washington’s state and local governments report known or suspected losses to the Office of the Washington State Auditor, as state law requires. An added benefit of the reports is our Office's ability to accumulate these losses by category and watch for patterns and trends in fraud schemes. This data started to tell a surprising story in 2018, when governments began reporting an increase in check fraud. The mostly steady increase in the number of cases has been even more surprising:

But Washington governments are not alone. The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) issued an alert in February 2023, stating that in 2021, financial institutions filed more than 350,000 reports of potential check fraud in 2021 (a 23% increase from the prior year), and more than 680,000 reports in 2022. According to the alert:

Fraud, including check fraud, is the largest source of illicit proceeds in the United States and represents one of the most significant money laundering threats to the United States, as highlighted in the U.S. Department of the Treasury’s most recent National Money Laundering Risk Assessment and National Strategy for Combatting Terrorist and other Illicit Financing.

In September 2024, FinCEN issued an updated release and Financial Trend Analysis, telling similar stories, and in late 2023, the U.S. Postal Inspection Service reported that its postal inspectors recover more than $1 billion in counterfeit checks and money orders every year.

Checks are still a preferred payment instrument

Despite the growing list of options to make payments – such as credit and debit cards, bill pay, payment apps and electronic bank payments – most organizations continue to use checks as their main payment method. Checks are accepted nearly everywhere, don’t tend to come with the same fees as electronic payments, and are easier to use for smaller or less sophisticated organizations.

Many organizations also prefer checks to electronic payments due to the internal controls they are able to build around approval and monitoring – such as requiring two physical signatures, monitoring check number sequences, and receiving cleared checks with the monthly bank statement showing payment and redemption details.

Vulnerability to fraud

However, despite the evolving technology around them, checks have not evolved much over the years, making them more vulnerable to fraud. For example, credit card companies are ditching signature lines and printed card numbers on the card, and are employing chip technology to help protect users. Meanwhile, checks still display the payor’s full banking information on the face of the check – providing ill-intended check recipients with all the information they need to carry out a scheme.

Further, the availability of mobile deposits allows bad actors to avoid standing face-to-face with a bank teller who may pick up on red flags. FinCEN’s September 2024 Financial Trend Analysis (FTA) reports that counterfeit checks are often made using incorrect check stock and security features – features that may be detected through an in-person deposit. The FTA confirms that bad actors are preferring deposit methods that avoid in-person contact - opening their depository accounts online and using ATMs or mobile/remote deposits.

As a result, the 2023 Association for Financial Professionals, Payments Fraud and Control Survey Report revealed that checks continue to be the payment method most vulnerable to fraud. In fact, 63% of respondents report that their organizations faced check fraud. Yet, about 75% of respondents plan to continue using checks.

Mail theft on the rise

How are bad actors getting these checks? Mostly through mail theft, ranging from simply pilfering through mailboxes on the street, to robbing postal carriers of not only mail, but their postal service key – granting them access to countless mail receptacles.

FinCEN’s 2023 alert provides an alarming look into the prevalence of mail theft through statistics from both the U.S. Postal Service (USPS), and it’s law enforcement, crime prevention and security arm, the U.S. Postal Inspection Service (USPIS).

-

Between March 2020 and February 2021, USPIS reported 299,020 mail theft complaints, which is a 161% increase compared to the prior year.

-

Between October 2021 and October 2022, the USPS and USPIS reported:

- More than 38,000 high-volume mail theft incidents from mail receptables (including blue USPS collection boxes)

- About 400 mail carriers robbed on duty

What governments, organizations and individuals can do to combat check fraud

-

Make your checks harder to wash by using a black gel pen. These pens are less reactive to chemicals used in check washing and tend to stain the check fibers. Brands such as Uni-ball and Pentel advertise a variety of their black gel pens as “fraud proof.”

-

Sign up for your bank’s “positive pay” services and ask if they offer other levels of protection. Positive pay is a proactive fraud detection service most banks offer to their business clients. When someone presents a check for payment, the bank compares it to a list of authorized checks the organization previously provided to the bank. The bank may compare details such as check number, dollar amount or payee, and will flag the organization for any discrepancies – giving the organization an opportunity to approve or reject the check.

Some banks may provide different levels of positive pay (confirming just the check number, or the check number and other fields), so it’s important to ask your bank about available levels of protection.

-

Monitor your bank account and cleared checks for suspicious activity. Look for the same check number clearing your account more than once, unexpected dollar amounts or check numbers out of sequence. Further, even if you see a check clear your account for the check number and dollar amount you expected, that isn’t a guarantee the right person received and deposited it. Examine the cleared check image to look for a change in payee or an unexpected endorsement on the back.

-

Shred your paper garbage. Banking information may be included on more than just checks. Printed bank statements, invoices and contracts may contain information helpful to a bad actor. Shredding your garbage either in-office or through a shredding company will help reduce the risk of bad actors getting this information.

-

Take measures to reduce mail theft such as the following recommendations:

- Drop off your outgoing mail at the post office

- Consider receiving your mail at the post office instead of your house

- If you don’t receive mail at the post office, use a locking mailbox

- When possible, deliver payments in person or pay online, rather than mailing a check

- Pick up your mail daily

- Use the USPS Informed Delivery service to receive emails with images of your mail daily (to ensure no mail was stolen before you checked it)

- If you plan to be out of town, place a hold on your mail with USPS

You can find more recommendations from USPIS at uspis.gov/tips-prevention/mail-theft and learn more about ways to protect yourself by accessing the infographic, “An Old Fraud with a New Look: Preventing Check Fraud,” from the Association of Certified Fraud Examiners at fraudweek.com.