Resource Library - Payroll

Payroll represents the largest expenditure category for most governments. Use SAO’s guides, checklists and best practices to help you develop or improve your government’s policies and internal controls related to timekeeping, overtime, leave and other payroll fundamentals.

Checklist: Segregation of duties

This customizable checklist can help governments analyze their own internal controls and identify risky areas in need of possible improvement. This is one of many helpful checklists our Office offers.

Keywords: Accounts Payable, Accounts Receivable, AP, AR, Assets, Cash Receipting, Receipt, Receipts, Internal Controls, Payroll

Last updated: December 2025

Guide: Segregation of duties

Segregation of duties, or separating conflicting duty assignments, can help you protect your government’s assets. This guide can help local governments understand how to separate job duties when it’s feasible. It covers all types of financial processes from cash receipting to payroll and banking. The guide also includes additional control options for small governments or small operations within larger governments.

Keywords: Accounts Payable, Accounts Receivable, AP, AR, Assets, Cash Receipting, Receipt, Receipts, Internal Controls, Payroll, Inventory, Procurement, Purchasing, General Ledger

Last updated: September 2019

Best Practices: ACH electronic payments

These best practices can help governments improve their ACH payment process policies and employee training, establish a verification process, and monitor for unauthorized payee account changes.

Keywords: Accounts Payable, AP, Automated Clearing House, Expenditure, Expenditures, Fraud Prevention, Government Operations, Internal Controls, Organizational Safeguards, Payroll, Online Banking, Disbursements, Direct Deposit

Last updated: August 2022

Guide: Payroll

This guide offers tips and suggestions for updating payroll processes and internal controls. It includes a suite of short, one-to-two-page resources for government leaders, managers, supervisors and payroll clerks. It can be printed in sections and distributed to whomever is in charge of certain responsibilities.

Keywords: Internal Controls

Last updated: September 2021

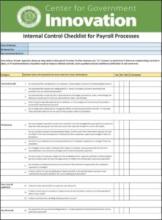

Checklist: Payroll

This customizable checklist can help governments analyze their internal controls for payroll processes to identify areas in need of possible improvement. This is one of many helpful checklists our Office offers.

Keywords: Internal Controls

Last updated: September 2021