BARS coding for revenue received from state opioid lawsuit

Oct 13, 2022

Updated: Feb 7, 2023

Attorney General Bob Ferguson announced Oct. 3, 2022, that 125 local governments in Washington would receive $215 million under a resolution with three companies found responsible for fueling the opioid epidemic.

The local governments that joined the resolution started receiving payments Dec. 1, 2022.

The governments receiving this revenue—whether using GAAP or Cash accounting methods—should use BARS code 369.40 – Judgments and Settlements when recording these funds into their accounting system. Generally, this resource will be reported as miscellaneous revenues in the financial statements.

Updated information as of Feb. 7, 2023

Governments should continue to use BARS code 369.40 – Judgments and Settlements when recording revenue. They should also follow the additional accounting guidance below.

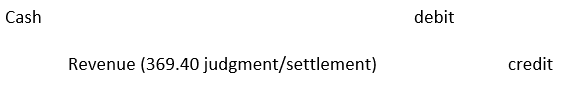

Cash basis governments

Record revenue when cash payments are received as follows:

Your government should report a restricted cash and investment balance for any amount of revenue recorded that remains unspent at fiscal year-end.

A printable PDF version of this guidance is also available in the BARS Alert section of the cash BARS Manual.

GAAP basis governments

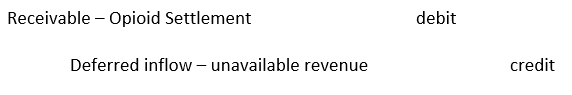

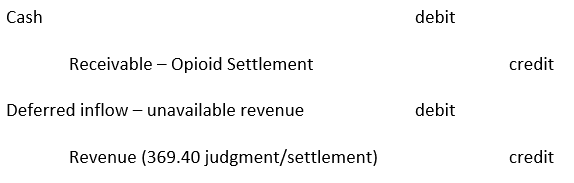

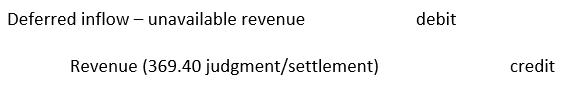

Modified accrual basis:

Since the settlement was finalized before the Dec. 31, 2022, fiscal year-end, record a receivable and a deferred inflow – unavailable revenue (if cash hasn't been received) for the expected settlement amount in the appropriate governmental fund. Note: measurement, contingency and collectability need to be assessed when recording the receivable. At this time, SAO is not aware of any needed adjustments related to contingencies.

Record the receivable and deferred inflow – unavailable revenue as follows:

Record payments received before fiscal year-end and future payments as follows:

Record year-end revenue accruals based on your government's policy for the availability period as follows:

Your government should report a restricted fund balance for any amount of revenue recorded that remains unspent at fiscal year-end.

Full accrual basis:

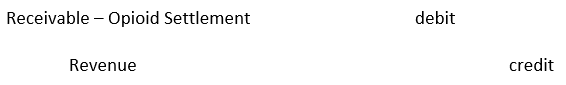

Record a receivable and revenue in the governmental activity's column of the entity-wide statements as follows:

Note: this revenue would be considered a general revenue, not program revenue.

Classify the restricted asset and restricted net position in the governmental activity's column of the entity-wide statements.

- Report the receivable and unspent cash as a “restricted asset”:

- GASB Codification 2200.180 states that restricted assets should be reported when restrictions on asset use change the nature or normal understanding of the availability of the asset.

- Report net position as “restricted”:

- GASB Codification 2200.712-7 states that restricted net position should represent the reported amount of restricted assets reduced by liabilities related to those assets.

A printable PDF version of this guidance is also available in the BARS Alert section of the GAAP BARS Manual.

For information on spending settlement funds

As independent auditors, SAO staff are unable to provide detailed guidance on how to spend these funds. A press release from the Attorney General's Office lists approved strategies for using the funds, and notes that local governments' spending decisions must be consistent with the state Opioid and Overdose Response Plan. For specific questions about appropriate use of funds and how they will be distributed, please contact Jeff Rupert, Complex Litigation Division Chief at the Office of the Attorney General, at jeffrey.rupert@atg.wa.gov.