This guidance does not represent legal or investment advice. Please consult with your legal counsel regarding the interpretation of language in leases, contracts, and other agreements.

GASB Statement No. 96, Subscription Based IT Arrangement (SBITA) and GASB Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements (PPP/APA) are effective for fiscal year 2023 reporting.

BARS GAAP and Cash manuals will be updated with the new requirements in late 2023.

The accounting and reporting requirements of these new standards are similar to the fiscal year 2022 implementation of leases.

What is SBITA?

Defined in GASB 96, a SBITA is a contract that conveys control of the right to use another party's IT software, alone or in combination with tangible capital assets as specified in the contract for a period of time in an exchange or exchange-like transaction.

Examples of potential SBITAs:

- Cloud computing arrangements

- Cloud based Enterprise Resource Planning (ERP) systems

- Online conferencing

- Online payment tools

- Email, calendar, office tools

This is not an all-inclusive list and provides a few ideas about what types of arrangements a government might have. Evaluation of current IT arrangements will be required to see if any meet the definition of a SBITA. If you have any questions or need help determining if one of your contracts is a SBITA, please contact the SAO HelpDesk.

Please see our training videos to the right, as well as links to important resources on this topic.

What is a PPP or APA?

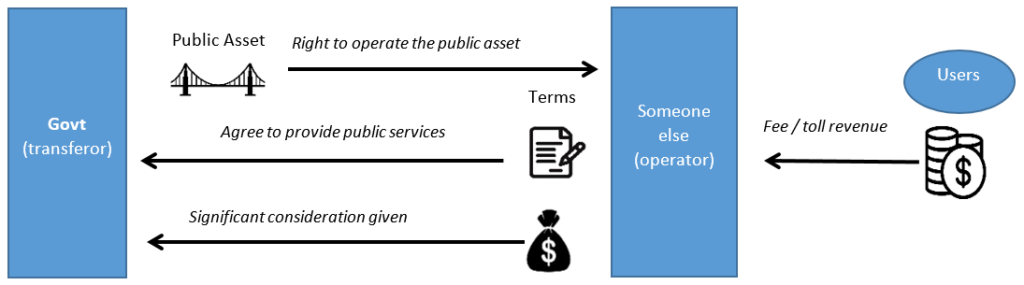

Defined in GASB 94, a PPP is an arrangement in which a government (the transferor) contracts with an operator to provide public services by conveying control of the right to operate or use a nonfinancial asset, such as infrastructure or other capital asset, for a period of time in an exchange or exchange-like transaction.

There is also a specific type of PPP called a Service Concession Arrangement (SCA). The government transferor is still giving the operator the right to use a public asset and obligation to provide public services, but this time it's in exchange for significant consideration (such as an up-front payment, installment payments, a new facility, or improvements to an existing facility). The operator is compensated by fees from third parties (such as the public) rather than from the government transferor. The government transferor also can modify or approve which services the operator provides, who the services are required to be provided to, and the prices that can be charged for the services. The government transferor is also entitled to significant residual interest in the service utility of the underlying PPP asset at the end of the arrangement.

Defined in GASB 94, an APA is an arrangement in which a government compensates an operator for activities that may include designing, constructing, financing, maintaining, or operating an underlying nonfinancial asset for a period of time in an exchange or exchange-like transaction. The payments by the government are based entirely on the asset's availability for use rather than on tolls, fees, or similar revenues or other measures of demand.

Please see our training videos to the right, as well as links to important resources on this topic.

Get Started!

Accounting for SBITAs and PPPs/APAs is applicable in fiscal year 2023. That means if the government's fiscal year end is December 31, SBITA and PPP/APA journal entries need to start on January 1, 2023.

So don't wait! Get started identifying these items and working on the accounting today.

Please contact SAO if you have any questions via the Help Desk.