The Audit Connection Blog

Good news on pension funding might mean changes for government financial reporting. SAO has guidance on how to report it

Since reporting a net pension asset can be cumbersome and complex for governments that haven’t had to do this previously, the pension experts at the State Auditor’s Office have compiled some guidance on how to report it in your financial statements. This article identifies which pension plans are reporting a net pension asset and explains how to report your restricted net position and a negative pension expense. ... CONTINUE READING

Are you converting to a new financial system? Follow SAO’s tips for a successful implementation

You’ve decided the time has come to upgrade your cash receipting system or billing system, or even to install a new financial management system, but where do you start? How do you ensure implementation goes to plan? SAO's new resource covers best practices before and after you go live with new financial or accounting software. ... CONTINUE READING

Keep software current to reduce cybersecurity risk

If you’re a smaller government without your own full-time information technology staff, you might find it challenging to stay on top of IT-related maintenance. Larger entities have entire departments dedicated to maintaining computer infrastructure, while you may be working with a part-time contractor or even volunteers to meet your IT needs. And that’s okay, but remember: having the latest security software, web browser and operating system on your devices is an important defense against cyberattacks. ... CONTINUE READING

People are looking at your FIT data—are you?

Your government’s data is in FIT, and it’s available to the public. Continue reading to learn who is looking at your data and why it’s in every local government’s the best interest to check it for accuracy. ... CONTINUE READING

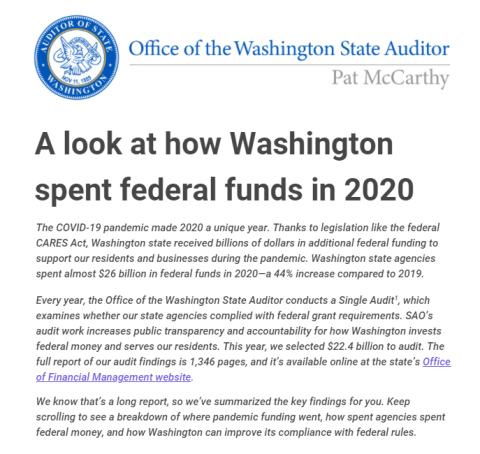

Summary infographic of the 2020 State of Washington Single Audit

Every year, SAO audits state agencies for compliance with certain requirements that come with federal awards. This visual report provides a summary of our 2020 Single Audit, including a breakdown of where pandemic funding went, how spent agencies spent federal money, and how Washington can improve its compliance with federal rules. ... CONTINUE READING

FIT’s projection feature pushes your finances into 2022 and beyond

Our Financial Intelligence Tool’s (FIT) “Add Projection” feature allows governments to adjust their known or anticipated revenues and expenditures, and then project those amounts into the future. Continue reading to learn how to access this feature and start projecting today. ... CONTINUE READING

K&P leadership series: Encouraging the heart

“Encourage the heart,” one of the five behaviors in the Kouzes and Posner (K&P) Leadership Challenge, can help you connect with your new team as a new leader. Encouraging the heart will help you create a team culture built on genuine respect and caring behavior. To do this, you need to focus on two areas at the same time: recognizing individual contributions and valuing team accomplishments. ... CONTINUE READING

New accounts payable checklist can help you create strong controls

We recently released a new accounts payable internal control checklist that you can use to evaluate your existing internal control systems and identify potential areas for improvement. Periodically reevaluating your control systems is a best practice. Your government should consider doing this annually, unless staffing or system changes require a more frequent review. ... CONTINUE READING

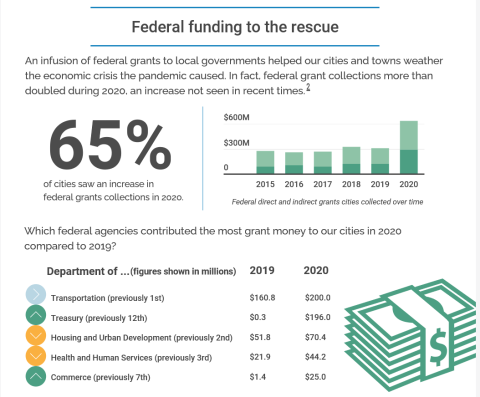

FIT Data Stories: New 2020 financial data tells a story of COVID-19

2020 was anything but normal, and we can look at the annual reports that Washington’s cities and towns recently submitted to see how the COVID-19 pandemic affected their operations. How did the pandemic affect sales tax collections? How did federal funding support our cities and towns as they navigated the economic challenges of the pandemic? ... CONTINUE READING

Increase your government’s account security with multi-factor authentication

Strengthening your government’s guard against the threats that compromised passwords pose is a necessary control for decreasing the risk of unauthorized users gaining access to your computers, network, or database. In this post, we explain how passwords get compromised and how multi-factor authentication (MFA) can help governments improve their account security to better protect their systems. ... CONTINUE READING