The Audit Connection Blog

Reduce your cyber risk while working from home

As local government workers get accustomed to working from home, there are a couple things our information technology experts here at the State Auditor’s Office consider to be some especially risky areas. This blog post covers the highest risk areas. ... CONTINUE READING

5 tips for managing employees’ stress during disruption

As a supervisor or manager, you play a key role in reducing the stress of your team members in times of disruption. Here are five things you can do to help your employees through an unexpected change such as teleworking during the coronavirus pandemic. ... CONTINUE READING

A message from State Auditor Pat McCarthy: Guidance and updates from the State Auditor's Office

Because of the efforts of Washingtonians from every corner of the state and every sector of the economy, we have seen hopeful signs in our fight against this pandemic. While we are by no means done, I think all of us can feel a sense of pride in what Washington has accomplished so far. ... CONTINUE READING

Changing your processes and controls? Remember these tips to minimize risk

The coronavirus pandemic likely is forcing you to change how you do your work, such as processing payroll or paying your bills. We understand that local governments need to get the work done, but we’d like to help you manage the risks that can come with new processes. ... CONTINUE READING

Are you a government employee working from home for the first time?

If you’re a government worker who has suddenly found themselves thrown into telework for the first time, the experience can be decentering. Here is a helpful list of tips to keep yourself productive in a virtual environment. ... CONTINUE READING

A message from State Auditor Pat McCarthy: An update on audit-related deadlines

The State Auditor’s Office has been working hard to find solutions to accommodate statutory and regulatory deadlines governments face, in light of the current emergency situation in our state. In that effort we have reached out to Gov. Inslee, and received assurances from his office, so we can address one issue through emergency declaration. ... CONTINUE READING

Tips, guidelines and more for local governments managing through coronavirus

Local governments are navigating many new areas while managing operations in response to coronavirus. We’d like to share some information so that everyone knows where to look for some important answers. ... CONTINUE READING

A message from State Auditor Pat McCarthy: How ‘stay home, stay healthy’ affects SAO

While we continue to analyze the details and impact of his proclamation, the operations of the State Auditor’s Office are largely unaffected by the Stay Home, Stay Healthy order. Here is what we already have been doing to support our state’s efforts to slow the rate of coronavirus infection. ... CONTINUE READING

A message from State Auditor Pat McCarthy regarding COVID-19

As all of Washington responds to the threat of COVID-19, I wanted to reach out to our partners in good government and let you know some steps the State Auditor’s Office is taking related to our audits of state agencies and local governments. ... CONTINUE READING

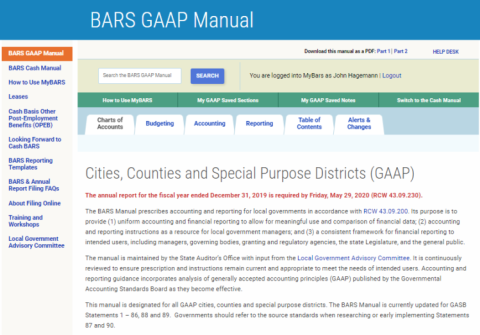

Annual BARS updates are live

The Budgeting, Accounting and Reporting System (BARS) Manuals for GAAP and cash basis governments have been updated and are available on our website at www.sao.wa.gov/, under “BARS & Annual Filing.” ... CONTINUE READING