The Audit Connection Blog

Where are your payments going this month?

It is common practice to use automated clearing house (ACH) systems to pay state and local government employees and vendors. However, frauds associated with ACH systems are rising dramatically, particularly for direct deposit paychecks. ... CONTINUE READING

SAO now issues public report on each fraud investigation

To meet stakeholders' needs and increase transparency, going forward SAO will report all fraud investigations through a public report that will be published on our website. In the past, smaller losses had been reported to management in a letter rather than in a public report. ... CONTINUE READING

New manager takes helm of South King County office

Saundra Groshong, audit manager for our South King County team, has left SAO after 19 years of service. Taking her place as team audit manager is Alex Beherndt. ... CONTINUE READING

More ways to #BeCyberSmart for the finance and legal departments of local governments

Cybersecurity is complex, and it can be hard to understand what your role is in keeping your organization safe from threats. The Center for Government Innovation has developed two new resources specifically for finance and legal staff at local governments. Staff in these departments play an important role in cybersecurity, and these resources provide understandable and actionable guidance and relevant information. ... CONTINUE READING

Auditor announces adjustment to hourly billing rate

This week, Auditor Pat McCarthy notified local governments of a coming adjustment to the hourly local audit billing rate. ... CONTINUE READING

Government data tells a story with FIT – just take a look at what you can learn about drainage and diking districts

The Office of the Washington State Auditor collects financial information from nearly 2,000 local governments each year and displays this data intuitively through the Financial Intelligence Tool (FIT). We explore what can be learned about government by being curious in their financial data. We encourage you to find something interesting and learn about all the local governments that serve the citizens of our state. What story will you find? ... CONTINUE READING

New resources identify best practices for credit card programs and travel expenditures

The Center for Government Innovation has published two new resources to help local governments identify best practices for two different, but possibly related areas: credit card programs and travel expenditures. ... CONTINUE READING

Find out where SAO's money comes from and where it goes

Curious where the State Auditor's Office gets its funding from, and how it spends that money? As part of our ongoing effort to increase transparency in government, we made a simple explanation of our $47.1 million budget for 2018. ... CONTINUE READING

Summary infographic of the 2018 State of Washington Single Audit report

The Single Audit examines whether Washington state agencies complied with federal grant requirements. This visual report provides a summary of Washington's 2018 Single Audit. ... CONTINUE READING

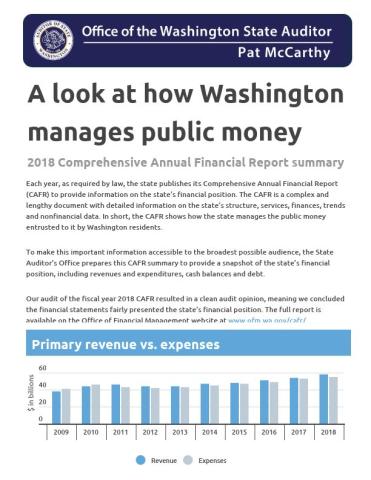

Summary infographic of Washington's 2018 Annual Comprehensive Financial Report

Each year, as required by law, the state publishes its Comprehensive Annual Financial Report (CAFR) to provide information on the state’s financial position. To make this important information accessible to the broadest possible audience, the State Auditor’s Office prepares this CAFR summary to provide a snapshot of the state’s financial position, including revenues and expenditures, cash balances and debt. ... CONTINUE READING