The Audit Connection Blog

Cybersecurity advice you can use

As a part of Cybersecurity Awareness month, the Center for Government Innovation at the Office of the Washington State Auditor has put together some important tips and advice for local governments on cybersecurity best practices. This one-page guide is quick and informative, with actionable items anyone who works for local government- from finance to HR, from leadership to IT—can take to reduce cyber risks and #BeCyberSmart. ... CONTINUE READING

Are you a finance professional in a local government? #BeCyberSmart.

As a finance or administrative professional in a local government, you have key responsibilities for managing that government's resources. In your role, you interact with all aspects of a local government's operations as you inform budgetary decisions. We've created a document with three things you can do right now as a finance professional to #BeCyberSmart. After you read it, make sure to take a look at all the resources we have available on our #BeCyberSmart webpage for local government employees. ... CONTINUE READING

Join MS-ISAC for National Cybersecurity Awareness Month

Don’t miss the Multi-State Information Sharing & Analysis Center (MS-ISAC) national webinar event to be held October 3, 2019, for national cybersecurity awareness month! ... CONTINUE READING

Piggybacking law change eases contract requirement

In 2019, the Legislature amended the statute to allow any public agency to use the bid of another public agency for its own purposes if the awarding agency met their own bidding requirements. This is a change to how our Office looks at piggybacking and group purchasing arrangements. For audit purposes, we would expect local governments to evaluate group purchasing contracts as outlined below. ... CONTINUE READING

Stay cyber safe during Cybersecurity Awareness Month

October ushers in the official fall—leaves scattering on the sidewalks, longer nights and a chilling breeze. The month of October also has special significance here at the State Auditor’s Office—Cybersecurity Awareness Month. All month long, we will be sharing cybersecurity resources to help governments of all sizes stay cyber safe. ... CONTINUE READING

Every government in Washington has a duty to safeguard the resources entrusted to it; our new guide shows you how

Segregation of duties, or separating conflicting duty assignments in your government, can help protect your local government’s assets. But which duties do you segregate, and what are your options if you cannot feasibly do this? What if you are a very small entity with limited resources? Our Office recognizes how challenging this can be, so the Center for Government Innovation created a new resource to help you get started, no matter your size. ... CONTINUE READING

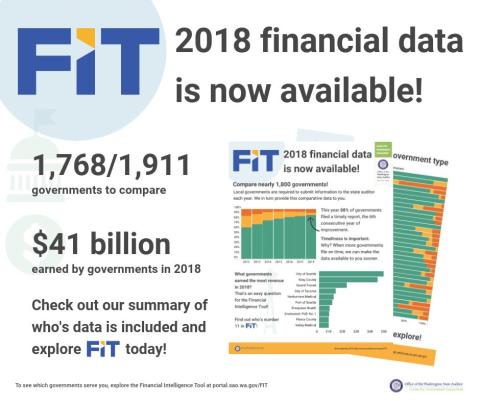

2018 Financial Data is Now Available!

The Financial Intelligence Tool (FIT) now contains the most recent financial information from nearly 1,800 local governments! ... CONTINUE READING

SAO passes peer review with flying colors

The Office of the Washington State Auditor recently passed its external peer review, which is a rigorous independent examination of the Office’s work conducted every three years. ... CONTINUE READING

SAO Roadshow taking the place of BARS Roundtables this fall

The Office of the Washington State Auditor is pleased to announce a new, expanded fall outreach event that takes the place of the BARS Roundtables. The SAO Roadshow will travel to a location near you beginning in October and offer a full day of assistance and training. ... CONTINUE READING

IT and facilities departments both can #BeCyberSmart

The Center for Government Innovation has developed two new cybersecurity resources to help local government professionals in IT departments but also in facilities departments as well. These resources provide guidance that is easy to understand and use. ... CONTINUE READING