The Audit Connection Blog

Follow best practice, state law when using third party receipting vendor

Many local governments use a third-party receipting vendor to provide electronic payment options to their constituents. Best practice – and state law (RCW 39.58.080) – require local governments to have all funds directly deposited into their Public Deposit Protection Commission (PDPC)-approved bank account. ... CONTINUE READING

Office identifies audit emphasis areas for school districts

School districts have asked the State Auditor’s Office for advance notice of what areas upcoming audits will emphasize. The following list identifies areas auditors might focus on to help districts prepare for audits examining fiscal year 2017. These areas are general in nature, and as always the specific areas audited will be determined by a risk-based analysis. Local audit teams also are available all year to answer technical questions and point to additional guidance on specific audit areas. ... CONTINUE READING

SAO’s Performance Center: Leaner name, but excellent service is the same

The Local Government Performance Center has been renamed The Performance Center. ... CONTINUE READING

Name brand procurements versus sole source contracts

Local governments have the ability to specify a name brand during their procurement process. In these situations, the government should thoroughly document why only this specific manufacturer’s equipment is necessary to meet their operational needs, as well as why another manufacturer’s equipment could not substitute. This documentation should be maintained and periodically evaluated to ensure that the specific brand is still required. ... CONTINUE READING

Pensions and other postemployment benefits (OPEB) update

The GAAP and cash basis BARS manuals have been updated, and the 2017 pension worksheet, notes and RSI templates are now available on our website at www.sao.wa.gov. The 2017 DRS Participating Employer Financial Information (PEFI) report is available at www.drs.wa.gov. Now that you have the information and tools you need to begin calculating your 2017 pension numbers, this is a great time to get started. As in the past, our Office will provide one-on-one assistance to local governments with their calculations. ... CONTINUE READING

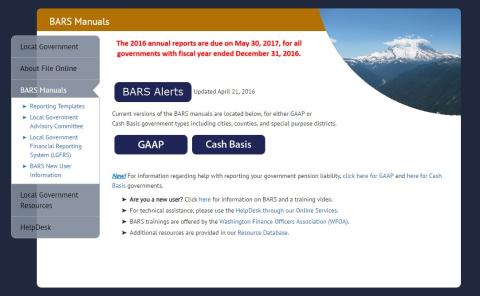

BARS Manual receives regular update for 2018

It’s that time of year again! The updated 2018 version of the Budgeting, Accounting and Reporting System (BARS) Manual will be available on our website in the third week of December. While users may notice several changes in this update, the most significant revision to the 2018 BARS Manual centers on reporting schedules for cities and counties, and specifically Schedule 07 – Cash Disbursements, and Schedule 11 – Cash Activity. A new schedule, Schedule 06 – Summary of Bank Reconciliation, makes an appearance in the 2018 cash-basis manual to accommodate those changes to Schedules 07 and 11. ... CONTINUE READING

Auditor McCarthy discusses her first year in Office: interview with Austin Jenkins

State Auditor Pat McCarthy sat down with TVW's Austin Jenkins in Olympia this week to talk about her first year in Office. Since taking Office in early 2017 as the 11th State Auditor and first elected woman Auditor, McCarthy has emphasized the importance of the Office's role in creating government transparency. "The Office is the public's window into government," McCarthy told Jenkins. Watch the full interview for more information on a variety of topics, including increasing accountability audits and cybersecurity efforts. ... CONTINUE READING

Local governments turn to Office of the Washington State Auditor for cybersecurity help

Did you know that the State Auditor offers free, in-depth evaluations of local government's cybersecurity systems? In an article published today, the Pew Charitable Trust details the cutting-edge role the Washington State Auditor has in ensuring the IT system security of local governments around the state. ... CONTINUE READING

Change Management, Lesson Two

Have you ever attended a training at work only to find you are expected to adopt the new technique next week? Chances are this has happened to you — how did it go? ... CONTINUE READING

Inside the Auditor’s request for funding for additional accountability audits

The Office of the Washington State Auditor has asked the Legislature for $700,000 to pay for more accountability audits of state agencies, one of Auditor Pat McCarthy’s initiatives to increase transparency and accountability in government. You can read the full request here. ... CONTINUE READING