The Audit Connection Blog

Helping local governments avoid costly cybersecurity breaches

Our Office is dedicated to helping local and state governments across Washington avoid the potentially devastating effects of cybersecurity attacks. Much of the public data governments hold is sensitive in nature, and needs to be carefully guarded. ... CONTINUE READING

Ensure your bank deposit slips are detailed

We have learned that not all banking institutions are providing a detailed breakout of cash and checks on bank validated deposit slips. If your banking records do not contain the detailed cash/check composition of your deposit, you will want to take corrective action as soon as possible. ... CONTINUE READING

Auditor's Office uses the same Lean methods it teaches to others

Our Office is committed to helping governments improve their operations. One way the Auditor’s Office does that is by leading Lean workshops for governments that ask for help improving a process. However, we also look for ways to improve our own Office as well, and we want to share the results of our process improvement efforts during 2017. ... CONTINUE READING

Changes to fiduciary reporting take effect soon

Last fall, we posted an article strongly encouraging governments to start evaluating activities that might be classified as fiduciary activities under the Governmental Accounting Standards Board’s (GASB) recently issued Statement No. 84. The changes to fiduciary activity reporting are right around the corner – effective for reporting periods beginning after December 15, 2018 – and affect not only governments that report under generally accepted accounting principles, but those that report using the cash-basis accounting model as well. ... CONTINUE READING

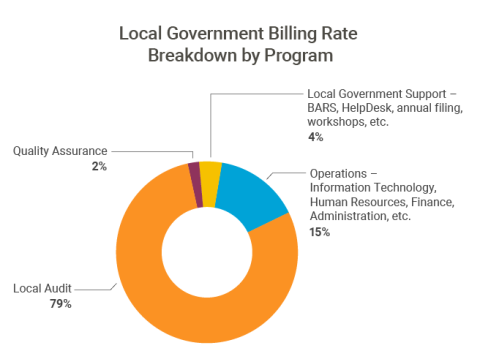

Local audit billing rate to rise in 2019

As you may have seen in Auditor Pat McCarthy’s letter Monday, the State Auditor’s Office is adjusting the hourly local audit billing rate in 2019. For further information, here are some background facts on the Office’s rates, plans and budget. ... CONTINUE READING

How Benton-Franklin Health District used Lean to make its immunization process work better

The Benton-Franklin Health District building is a clean, modern facility, shining brightly from its location tucked behind a shopping center and other businesses. The waiting room is spacious, and the interior brims with helpful pamphlets about preventing common diseases, staying healthy and knowing when to visit your doctor. The facility is designed to put clients at ease as they wait for their appointments. Health District employees care about their clients and have designed their space around their clients’ comfort. ... CONTINUE READING

When it comes to cybersecurity experts, our Office boasts some of the best

Photo courtesy of the Washington Army National Guard In early July, our Senior IT Security Specialist Sunia (Lulu) Laulile (pictured)participated in the International Collegiate Cyber Defense Invitational at Highline College in Des Moines, Washington. In this exercise, Lulu's team attacked the systems the students were defending. You can read more about this event on the Washington Army National Guard's blog. ... CONTINUE READING

Auditor's Office effort spurs clarification of Energy Independence Act rules

The Act requires electric utilities with at least 25,000 customers to use renewable energy for part of their electricity supply. A utility whose retail power sales have not grown may choose to use a compliance method that allows it to use or invest in less renewable energy than the law would otherwise allow. The utility could continue to use the energy it purchased from resources such as hydroelectric, nuclear or fossil fuel. ... CONTINUE READING

The Complaint Resolution Unit within the Aging and Long-term Support Administration receives a State Auditor's Office Stewardship Award

Department’s Complaint Resolution Unit (CRU) and field operations within the Aging and Long-Term Support Administration made significant improvements to resolve a long-standing audit finding and improve services to its clients. ... CONTINUE READING

How is federal money spent in Washington? Explore the 2017 SWSA summary plus data visualization

In 2017, Washington state spent more than $17.5 billion in federal money. Each year, the State of Washington Single Audit (SWSA) examines whether state agencies complied with federal requirements for those funds. As a whole, the state does meet those requirements. Today, we published our summary of the longer, more comprehensive report, together with an interactive data visualization available on our website. Please check it out, and let us know what you think in the comments. ... CONTINUE READING