4 Reporting

4.1 Reporting Principles and Requirements

4.1.6 Reporting Requirements and Filing Instructions for Special Purpose Districts

4.1.6.10 Pursuant to RCW 43.09.230, Annual Reports are to be certified and filed with the State Auditor’s Office (SAO) within 150 days after the close of each fiscal year.

|

Special Purpose Districts |

||

|

Statements and Schedules |

No Financial Activity |

With Financial Activity |

| C-4 Fund Resources and Uses Arising from Cash Transactions |

X - see caution |

X - see caution |

| C-5 Fiduciary Fund Resources and Uses Arising from Cash Transactions |

X - see caution |

X - see caution |

| 01 Revenues/Expenditures/Expenses |

X |

X |

| 09 Liabilities3 |

N/A |

X |

| 15 Expenditures of State Financial Assistance3 |

N/A |

X |

| 16 Expenditures of Federal Awards3 |

N/A |

X |

| 21 Risk Management |

N/A |

X |

| 22 Assessment Questionnaire 1 |

See footnote 2 |

See footnote 1 |

X Required to be prepared by special purpose districts and submitted to SAO.

N/A Not applicable; not required to be prepared by special purpose districts.

Footnote:

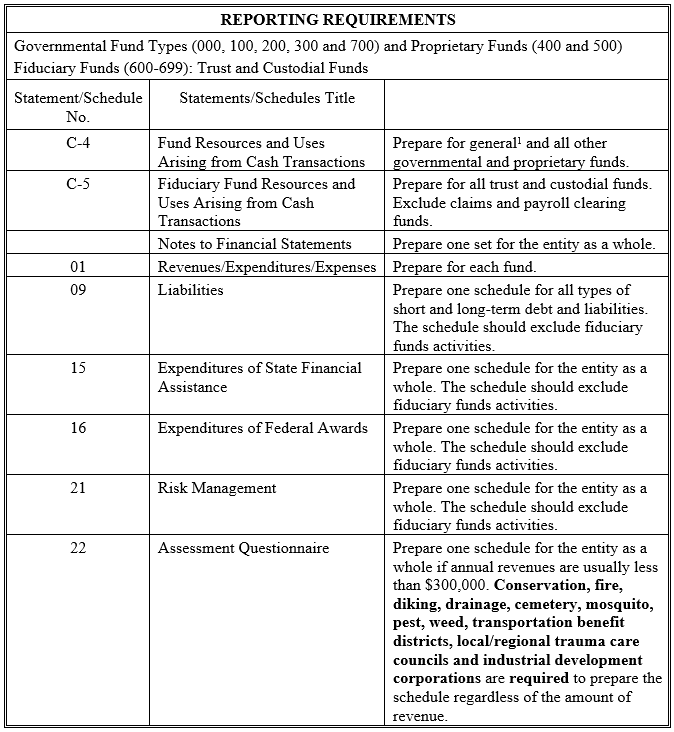

[1] The Schedule 22 questionnaire is required for all special purpose districts that receive less than $300,000 in annual revenue. Some government types are required to complete the schedule regardless of annual revenue, such as conservation, fire, etc. See BARS Manual 4.8.14, Assessment Questionnaire (Schedule 22) for a complete list of government types required to complete this schedule.

[2] No Financial Activity reports do not require a formal Schedule 22 to be completed. Governments who file a no activity report will be required to submit supporting documents to confirm no activity, such as meeting minutes, county reports and/or bank statements.

[3] Only required if the activity applies to the government for the reporting year. Please see schedule instructions in the reporting section of the BARS Manual.

Caution

4.1.6.20 The SAO filing system will automatically produce the C-4 and C-5 statements for all cash basis local governments. Note that local governments with total revenues of $2 million or less are not required to prepare a financial statement package unless debt covenants, a contract, a grantor or the government’s legislative body requires the government to prepare the financial statements or if the government is to receive a financial statements audit. If this request is made, the financial statement package containing the C-4 and C-5 statements and notes should be prepared. The $2 million threshold calculation excludes any proceeds from issuance of long-term debt and resources held by the government in its fiduciary capacity.

4.1.6.25 Local governments with no financial activity, defined as having neither expenditures, other than small automatic bank fees (such as dormant account fees) and the state auditor's office audit billings, nor revenues other than interest income on any cash balances, have the option to submit summarized annual reports. These governments need to submit a Schedule 01 reporting cash balances at the beginning and end of the reporting year as well as any investment income received on those balances if applicable. These governments also will be required to submit no activity supporting documents such as meeting minutes and county reports and/or bank statements verifying no activity. Note that by selecting this submission option, preparers of the annual reports are certifying that their government meets the definition of no activity as explained above.

For questions and/or support e-mail the SAO HelpDesk through our Online Services.

4.1.6.30 If more than $750,000 in federal funding was expended by the entity during the year and a federal single audit is required, the entity must prepare financial statements if it has expenditures of federal money from more than one program or cluster. However, an entity that normally does not prepare financial statements may not need to prepare them for the single audit if it has expenditures from only one program or cluster. Entities should consult with their local SAO audit team or the SAO HelpDesk if they have questions about this requirement.

4.1.6.40 Forms

The templates for the filing system are available on the BARS Reporting Templates page on the SAO website. The filing system will only accept the forms in the prescribed layout, so do not alter the templates. The templates are designed as a tool to import data into the filing system. Once the data is imported via the template or manual input, the filing system provides the option to export each schedule in a professional formatted version.

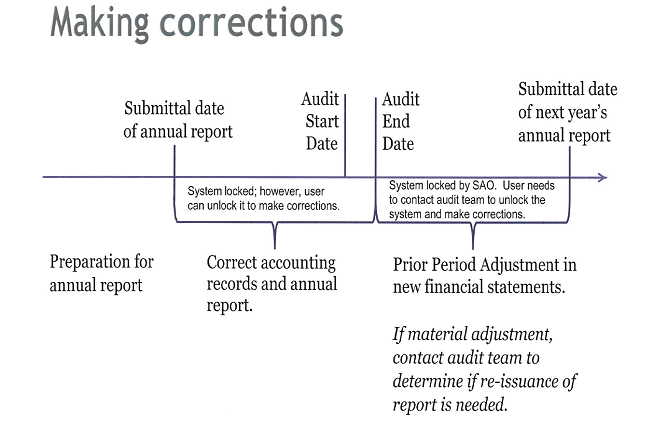

4.1.6.50 Subsequent corrections

All subsequent discoveries of errors and omissions in the annual report – from the date of original submission up through the end of the audit applicable to that period – are required to be corrected by resubmitting the annual report. For any misstatements discovered during the audit, governments should ensure open communication with the audit team about the correction. Any misstatements discovered after the audit is completed that affect Schedule 01 should be recorded as a prior period adjustment. If misstatements discovered after completion of the audit are material, governments should immediately alert their audit team.

4.1.6.60 Filing instructions

Electronic reporting is encouraged when filing annual reports. Annual reports should be submitted via the filing system on the State Auditor’s website at: SAO. For assistance with filing the government’s annual report, please review the BARS & Annual Report Filing FAQ page for resources.

For questions and/or support e-mail the SAO HelpDesk through our Online Services.

If the special purpose district cannot provide the annual report via the filing system, mail the annual report to:

Annual Report

State Auditor’s Office

Local Government Support Team

P.O. Box 40031

Olympia, WA 98504-0031

CAUTION: if the local government chooses to mail the annual report, please confirm the government is using the most current version of the prescribed templates found on the BARS Reporting Templates page.

The conservation districts are also required to submit their annual report to:

Washington State Conservation Commission

PO Box 47721

Olympia, WA 98504-7721

4.1.6.80 The following matrix describes required statements and schedules for cash basis special purpose districts and the scope of each schedule.

Footnote:

[1] There should be only one general fund. Also, if the local government accounts for the debt and capital projects related to proprietary activities in funds other than proprietary, these activities should be incorporated in the appropriate proprietary fund. All interfund transactions between funds which are combined for reporting purposes should be eliminated to avoid double counting.