3 Accounting

3.1 Accounting Principles and Internal Controls

3.1.7 Fund Accounting and Fund Types

3.1.7.10 The following principles are basic rules of accounting and financial reporting for cash basis cities, counties and special purpose districts.

3.1.7.20 Accounting and reporting capabilities

A governmental accounting system must make it possible to determine and demonstrate compliance with finance related legal and contractual provisions.

3.1.7.30 Fund accounting systems

A governmental accounting system should be organized and operated on a fund basis. A fund is defined as a fiscal and accounting entity with a self-balancing set of accounts recording cash and other financial resources, together with all related expenditures and residual balances, and changes therein, which are segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations, restrictions, or limitations.

3.1.7.40 Types of funds

In fund financial statements, governments should report governmental, proprietary, and fiduciary funds to the extent that they have activities that meet the criteria for using these funds. Presented below is a system to classify all funds used by local government and the assignment of code numbers to identify each type of fund. A three-digit code is used: the first digit identifies the fund type, and the next two digits will be assigned by the government to identify each specific fund.

Since counties account for special purpose districts in their accounting systems as fiduciary funds, they often provide the districts with reports showing assigned fund codes 630-699. These codes refer to the fund from the county perspective. A district has to “reassign” the county code to the code appropriate to the fund type it is reporting (e.g., if the district’s general fund is coded in the county records as 663, the district in its annual report has to code this fund as 001).

For reporting purposes local governments are required to follow the described below fund structure. However, the local governments may create other funds for accounting or managerial purposes. When preparing external financial reports, those accounting or managerial funds should be rolled to appropriate fund types (e.g., there should be only one general fund or if an entity accounts separately for operating, capital or/and debt activities of its proprietary function, those activities should be rolled up into the appropriate enterprise fund, etc.)

Governmental funds

Code 000 - General (Current Expense) Fund – should be used to account for and report all financial resources not accounted for and reported in another fund. For reporting purposes, the local government can have only one general fund.

Although a local government has to report only one general fund in its external financial reports, the government can have multiple subfunds for its internal managerial purposes. These managerial subfunds should be combined into one general fund for external financial reporting.

Code 100 - Special Revenue Funds – should be used to account for and report the proceeds of specific revenue sources that are restricted or committed to expenditure for specific purposes other than debt service or capital projects. Restricted revenues are resources externally restricted by creditors, grantors, contributors or laws or regulations of other governments or restricted by law through constitutional provisions or enabling legislation. Committed revenues are resources with limitations imposed by the highest level of the government (e.g., board of commissioners, city council, etc.) through a formal action (resolution, ordinance) and where the limitations can be removed only by a similar action of the same governing body. Revenues do not include other financing sources (long-term debt, transfers, etc.).

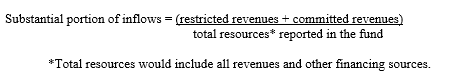

The term proceeds of specific revenue sources establishes that one or more specific restricted or committed revenues should be foundation for a special revenue fund. They should be expected to continue to comprise a substantial portion of the inflows reported in the fund. It is recommended that at least 20 percent is a reasonable limit for restricted and committed revenues to create a foundation for a special revenue fund. Local governments need to consider factors such as past resource history, future resource expectations and unusual current year inflows such as debt proceeds in their analysis.

They may use the calculation below to determine whether an activity would qualify for reporting as a special revenue fund.

Other resources (investment earnings and transfers from other funds, etc.) also may be reported in the fund if these resources are restricted, committed, or assigned (intended) to the specific purpose of the fund.

Governments should discontinue reporting a special revenue fund, and instead report the fund’s remaining resources in the general fund, if the government no longer expects that a substantial portion of the inflows will derive from restricted or committed revenue sources.

All revenues must be recognized in the special revenue fund. If the resources are initially received in another fund, such as the general fund, and subsequently remitted to a special revenue fund, they should not be recognized as revenue in the fund initially receiving them. They should be recognized as revenue in the special revenue fund from which they will be expended.

Special revenue funds should not be used to account for resources held in trust for individuals, private organizations, or other governments.

The state statutes contain many requirements for special funds to account for different activities. The legally required funds do not always meet standards for external reporting. So, while the local governments are required to follow their legal requirements, they will have to make some adjustment to their fund structure for external financial reporting.

Code 200 - Debt Service Funds – should be used to account for and report financial resources that are restricted, committed, or assigned (intended) to expenditure for principal and interest. Debt service funds should be used to report resources if legally mandated. Financial resources that are being accumulated for principal and interest maturing in future years also should be reported in debt service funds. The debt service transactions for a special assessment for which the government is not obligated in any matter should be reported in a custodial fund. Also, if the government is authorized, or required to establish and maintain a special assessment bond reserve, guaranty, or sinking fund, it is required to use a debt service fund for this purpose.

Note: Debt service funds should not be used in proprietary funds (400 and 500). Use enterprise funds (400) or internal service (500) for debt payments related to utilities and other business type activities.

Code 300 - Capital Projects Funds – should be used to account for and report financial resources that are restricted, committed, or assigned (intended) for expenditure for capital outlays including the acquisition or construction of capital facilities or other capital assets. Capital outlays financed from general obligation bond proceeds should be accounted for through a capital projects fund. Capital project funds exclude those types of capital-related outflows financed by proprietary funds or for assets that will be held in trust for individuals, private organizations, or other governments (private-purpose trust funds).

Note: Capital project funds should not be used in proprietary funds (400 and 500). Use enterprise funds (400) or internal service (500) for capital payments related to utilities and other business type activities.

Code 700 - Permanent Funds – should be used to account for and report resources that are restricted to the extent that only earnings, and not principal, may be used for purposes that support the reporting government’s programs – that is for the benefit of the government or its citizens (public-purpose).

Generally, only the principal amounts, interest revenue, and transfers to the appropriate operating fund for interest revenue use should be reported in this fund. Note: if the allowable use of the interest earnings is related to operating expenses that are normally reported in another fund, the permanent fund should transfer the allowable amount to the appropriate operating fund.

Permanent funds do not include private-purpose trust funds which account for resources held in trust for individuals, private organizations, or other governments.

Proprietary funds

Code 400 - Enterprise Funds – may be used to report any activity for which a fee is charged to external users for goods or services. Enterprise funds are required for any activity whose principal revenue sources meet any of the following criteria:

- Debt backed solely by a pledge of the net revenues from fees and charges.

- Legal requirement to recover cost. An enterprise fund is required to be used if the cost of providing services for an activity including capital costs (such as depreciation or debt service) must be legally recovered through fees or charges.

- Policy decision to recover cost. It is necessary to use an enterprise fund if the government’s policy is to establish activity fees or charges designed to recover the cost, including capital costs (such as depreciation or debt service).

These criteria should be applied in the context of the activity’s principal revenue source.

The term activity generally refers to programs and services. This term is not synonymous with fund. As a practical consequence, if an activity reported as a separate fund meets any of the three criteria, it should be an enterprise fund. Also, if a “multiple activity” fund (e.g., general fund) includes a significant activity whose principal revenue source meets any of these three criteria, the activity should be reclassified as an enterprise fund.

The determination of an activity’s principal revenue source is a matter of professional judgement. A good indicator of the activity’s significance may be comparing pledged revenues or fees and charges to total revenue. For example, consider a county auditor’s office that charges fees to provide a payroll service to various taxing districts. Even if the fee is meant to cover the cost of the service, the county auditor function as a whole is primarily supported with tax dollars from the general fund. It would be allowable in this case to leave the activity all within general fund.

Finding an appropriate fund type requires a careful analysis since there is not always a clear choice. For example, building permit fees may be accounted for in the general fund or a special revenue fund in certain circumstances, such as when they are partially supported by taxes. However, if there is a pricing policy to recover the cost of issuing those individual building permits, they should be reported in an enterprise fund.

Separate funds are not required for bond redemption, construction, reserves, or deposits, for any utility. If separated, use 400 series number. Separate funds are not required even though bond covenants may stipulate a bond reserve fund, bond construction fund, etc. The bond covenant use of the term fund is not the same as the use in governmental accounting. For bond covenants, fund means only a segregation or separate account, not a self-balancing set of accounts.

Local governments may separate operating, capital projects and debt functions of enterprise funds. However, when reporting such proprietary activities, all those functions should be rolled into one fund.

Code 500 - Internal Service Funds – may be used to report any activity that provides goods or services to other funds, departments or agencies of the government, or to other governments, on a cost-reimbursement basis. Internal service funds should be used only if the reporting government is the predominant participant in the activity. Otherwise, the activity should be reported in an enterprise fund. Cash basis special purpose districts (such as a fire or water district) should not use the internal service fund category.

Note: When calculating the predominant participant, purchases from fiduciary funds would be considered part of the reporting government’s activity, but the BARS coding would still be to an external customer.

Fiduciary funds

In general, fiduciary funds are resources that are held by a government for the benefit of others.

To determine if an activity should be reported in a fiduciary custodial fund see Determining Fiduciary Activities to be Reported in Custodial Funds.

If activity is determined to be fiduciary, the funds should be reviewed for trust arrangements and equivalents. The three criteria for determining if a fiduciary activity is a trust are:

- The government itself is not a beneficiary

- Dedicated to providing benefits in accordance with the benefit terms

- Legally protected from the government’s creditors

Code 600 - Fiduciary Funds – should be used to account for assets held by a government in a trustee capacity or as a custodian for individuals, private organizations, other governmental units, and/or other funds. These include (a) investment trust funds, (b) pension (and other employee benefit) trust funds, (c) private-purpose trust funds, (d) custodial funds and (e) external investment pool funds.

Code 600-609 - Investment Trust Funds – should be used to report fiduciary activities from the external portion of investment pools and individual investment accounts that are held in a trust or equivalent that meets the criteria above.

In addition to the trust criteria requirements above, all individual investment accounts are required to be reported in an Investment Trust Fund.

Code 610-619 - Pension (and Other Employee Benefit) Trust Funds – should be used to report fiduciary activities for pension plans and OPEB plans that are administered through qualifying trusts. Qualifying trusts are those in which:

- Contributions to the plan, and earnings on those contributions, are irrevocable. Pay-as-you-go plans do not qualify because they are “payments,” not contributions.

- Plan assets are dedicated solely to providing benefits to plan members in accordance with the benefit terms. Different plans (for example a pension and an OPEB plan) cannot be commingled in the same trust. The assets must be partitioned for specific plans.

- Plan assets are legally protected from creditors.

If you are acting as administrator for someone else’s pension/OPEB plans, the plans still must meet the criteria above to be reported in a trust fund.

Code 620-629 - Private-Purpose Trust Funds – should be used to report all fiduciary activities that (a) are not required to be reported in pension (and other employee benefit) trust funds or investment trust funds, and (b) are held in a trust that meets the following criteria: the assets are (a) administered through a trust or equivalent that meets the criteria above.

Code 630-698 - Custodial Funds – should be used to report all fiduciary activities that are not required to be reported in pension (and other employee benefit) trust funds, investment trust funds or private purpose trust funds. The external portion of the investment pools that are not held in trust that meets criteria listed above should be reported in a separate external investment pool fund column under the custodial funds classification.

Note: The custodial funds are required to be used by business-type activities and enterprise funds, except when the resources will normally be held for less than ninety (90) days.

Code 699 - External Investment Pool Fund – The external portion of the investment pools that are not held in trust and meet criteria listed above. Although this is considered a custodial fund, it should be reported in a separate external investment pool fund column under the custodial funds classification.

3.1.7.50 Number of funds

Governments should establish and maintain those funds required by law and sound financial administration. Only the minimum number of funds consistent with legal and operating requirements should be established. Using numerous funds results in inflexibility, undue complexity, and inefficient financial administration.

Local governments should periodically undertake a comprehensive evaluation of their fund structure to ensure that individual funds that became superfluous are eliminated from accounting and reporting.

Elected officials should be educated to the fact that accountability may be achieved effectively and efficiently by judicious use of department, program and other available account coding or cautious use of managerial (internal) funds.