3 Accounting

3.4 Liabilities

3.4.14 Refunding Debt

3.4.14.10 Any government in the state of Washington may extinguish (pay off) debt prior to the debt maturity date. This may be done with existing resources or by issuing new debt, which is referred to as a “refunding.” Refunding is authorized by Chapter 39.53 RCW also known as the Refunding Bond Act.

3.4.14.20 Refunding bonds may be issued to immediately repay old debt or may be issued now to repay debt in the future when it matures or becomes callable, which is referred to as an “advance refunding.”

Usually refunding is done to take advantage of lower interest rates or to modify debt service requirements. Often the proceeds from the sale of new debt with a lower interest rate are used to pay off old debt with a higher interest rate. While there are costs associated with issuing bonds, refunding results in a net cost savings when the present value of savings from lower interest payments on the refunding debt plus any income from temporary investment of refunding debt proceeds pending redemption of debt to be refunded are greater than the present value of the fees, sales discounts, redemption premiums and other costs of refunding.

3.4.14.30 The following definitions apply to the terms used here:

- Refunding debt (sometimes referred to as new debt) - debt issued to provide funds to replace the refunded debt at specified dates.

- Refunded debt (sometimes referred to as old debt) - debt for which payment at specified dates has been provided by the issuance of refunding debt.

3.4.14.40 Advance refunding may be either a legal or an in-substance defeasance.

3.4.14.50 A legal defeasance occurs when debt is legally satisfied based on certain provisions in the debt instrument, even though the debt is not actually paid. A legal defeasance is rare in the government environment and generally occurs only when an amount sufficient to pay both principal and interest at the time of deposit is placed in an irrevocable trust with an independent escrow agent. A government is released from its legal status as the primary obligor on outstanding indebtedness after an escrow account is established, leaving the government only contingently liable.

3.4.14.60 An in-substance defeasance debt occurs when debt is considered to be extinguished for financial reporting purposes even though a government has not met legal requirements for a defeasance and so legally remains the primary obligor on the indebtedness. The proceeds from the sale of refunding (new) debt together with any other funds the entity may set aside for payment of refunded debt must be irrevocably placed with an escrow agent in a trust. The escrow agent invests the proceeds so that the cash realized from the maturing investments together with interest earned will meet the debt service requirements of the refunded (old) debt and redeem the balance of the old debt when it becomes callable or matures. Cash or other assets used for refunding must qualify as “essentially risk-free as to amount, timing and collection of principal and interest” and they must provide cash flows that are sufficient and timed to match the scheduled interest and principal payments on the debt that is being extinguished. Also, the chance of the government being required to make any additional future payments must be remote.

3.4.14.70 Generally, the requirement for “essentially risk-free” securities may be accomplished through the purchase of U.S. government securities, securities guaranteed by the U.S. government, or U.S. government backed securities.

3.4.14.80 The government does not budget or report any refunded (old) debt. However, the government is responsible for verifying the amounts reported by the trustee. The amount of the old debt should be disclosed in a note to financial statements.

3.4.14.90 Since cash basis statements reflect only the financial resource flows related to the refunding transaction, they do not report a gain or loss on an advance refunding resulting in defeasance.

3.4.14.100 The provisions of the Refunding Bond Act (Chapter 39.53 RCW) satisfy the criteria for in-substance defeasance, except for the requirement to place cash and assets in an irrevocable escrow. If the irrevocable trust fund is not established, both the refunded (old) and the refunding (new) debt must be recorded and reported on the government’s Schedule of Liabilities (Schedule 09).

Often the refunding is coordinated by the underwriter and the money from the issuance of the new debt is directly forwarded to the escrow account. Regardless how the money is physically handled, the city/county/district is a party to and responsible for the transaction and therefore should account for and report the transaction on their financial statements. The omission of this transaction from accounting or reporting will be most likely a material error.

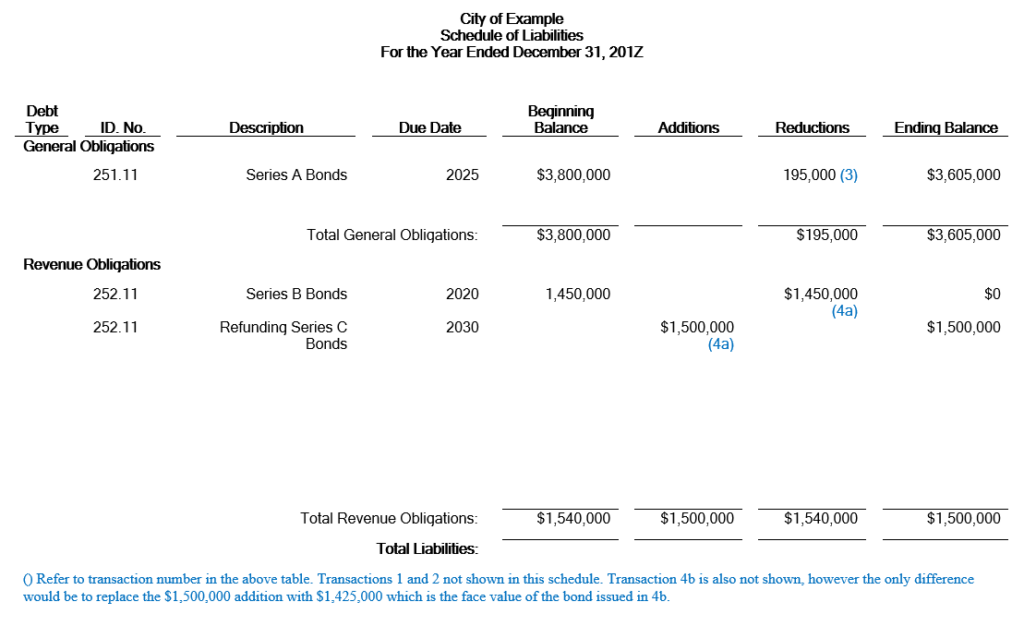

The following example illustrates the BARS coding and reporting of the regular and refunding transactions.

Transaction 1: The government issues Series A Bond with a $5,000,000 face value at a premium of $200,000 and with $30,000 in issuance costs. The government receives $5,170,000 in cash:

| Cash | $ 5,170,000 |

| 592PP80 Issuance Cost | $ 30,000 |

| 391PP00 Issuance of debt (face value) | $ 5,000,000 |

| 3920000 Premium on bonds issued | $ 200,000 |

Transaction 2: The government issues Series B Bond with a $2,000,000 face value at a discount of $100,000 and with $10,000 in issuance costs. The government receives $1,890,000 in cash:

| Cash | $ 1,890,000 |

| 592PP80 Issuance Cost | $ 10,000 |

| 593PP70 Discount on bonds issued | $ 100,000 |

| 391PP00 Issuance of debt (face value) | $ 2,000,000 |

Transaction 3: The government makes payments on the Series A & B bonds:

| Cash | $ 395,000 |

| 591PP70 Annual principal | $ 195,000 |

| 592PP80 Annual interest | $ 200,000 |

| Cash | $ 150,000 |

| 591PP70 Annual principal | $ 80,000 |

| 592PP80 Annual interest | $ 70,000 |

Transaction 4a: Refunding with no additional payment to escrow

Years later the government issues Series C Refunding Bond with a face value of $1,500,000 at a premium of $100,000 with $50,000 in issuance costs to refund the Series B bond. At the time of the refunding Bond B’s outstanding principal balance was $1,450,000 and there was accrued interest of $100,000:

| 599PP70 Payment for refunded debt – principal | $1,450,000 |

| 599PP80 Payment for refunded debt – interest | $ 100,000 |

| 592PP80 Issuance Cost | $ 50,000 |

| 3930000 Refunding Long-Term Debt Issued | $ 1,500,000 |

| 3920000 Premium on bonds issued | $ 100,000 |

Transaction 4b: Refunding with additional payment to escrow

Years later the government issues Series C Refunding Bond with a face value of $1,425,000 at a premium of $100,000 with $50,000 in issuance costs to refund the Series B bond. At the time of the refunding Bond B’s outstanding principal balance was $1,450,000 and there was accrued interest of $100,000. The City needs to contribute $75,000 in addition to the proceeds from the Series C Refunding Bonds:

| Cash | $ 75,000 |

| 599PP70 Payment for refunded debt – principal | $1,375,000 |

| 593PP70 Advance Refunding Escrow | $ 75,000 |

| 599PP80 Payment for refunded debt – interest | $ 100,000 |

| 592PP80 Debt Service Cost | $ 50,000 |

| 3930000 Refunding Long-Term Debt Issued | $1,425,000 |

| 3920000 Premium on bonds issued | $ 100,000 |

Note: Normally the government would report $1,450,000 to BARS 599PP70 for the payoff of the old debt’s principal as shown in transaction 4a. However the payment to escrow of $75,000 needs to be recorded to BARS account 593PP70. Both of these accounts use object code 70 Debt Service principal. Therefore when the government records the Advance Refunding Escrow of $75,000, they are recording a partial payment of the principal, so we need to reduce the 599PP70 account by $75,000. In the end the total principal payment is still $1,450,000 ($1,375,000 + $75,000).