4 Reporting

4.14 Supplementary and Other Information

4.14.13 Liabilities (Schedule 09)

4.14.13.10 The purpose of this schedule is to provide information about the liabilities of the local government. This schedule is required to be included as supplementary information with any audited financial statements.

4.14.13.30 Local governments are required to update the incorrect financial data submitted on this schedule. The requirement applies to all errors found prior or during an audit.

4.14.13.40 The schedule should be prepared on the same basis of accounting, for the same period and reporting entity, and using the same underlying accounting records as the Schedule 01 and financial statements. The schedule should include current and noncurrent liabilities. Local governments should report short-term liabilities even if they are both incurred and fully redeemed during the reporting period.

4.14.13.50 The schedule should exclude the following:

-

Payments due to vendors or employees that are expected to be paid normally as part of the disbursement cycle. For example, any accounts payable, payroll accruals, retainage payable, or customer deposits.

-

Short-term leases or subscriptions where the maximum possible term is 12 months or less. For example, month-to-month contracts.

-

Contracts or commitments for expenditures that have not yet been realized.

-

Interfund payables and loans (for details regarding interfund loans see Interfund Loans).

-

Liabilities of fiduciary funds or of other entities for which the government is not itself obligated. For example, conduit debt, financial guarantees (unless the government estimates it will need to make payments), and assessment debt without commitments. Counties would not report liabilities of their special purpose districts.

4.14.13.71 Proper classification of grant and loan transactions require the analysis of the underlying documentation. The criteria for determining if a funding source is a grant (revenue) or loan (other financing source) is the existence of a note payable or loan contract. For annual report purposes, Schedule 09 should report all loans. Federal grant loans will be reported on both the Schedule 09 and 16.

4.14.13.90 All debt should be listed on Schedule 09, regardless of if it is for operating, capital or refunding purposes. Debt should be reported at face value (that is, only the principal amounts of debt should be reported and not any anticipated interest, issuance costs, premiums, or discounts).

Refunding transactions (including advance refunding through legal or in-substance defeasance) should be reported on the schedule as reduction of the refunded debt and addition of the new debt.

4.14.13.100 All the following types of liabilities should be included in the schedule using the most appropriate identifying number.

Note: There are three categories of liabilities: General Obligation, Revenue and Other, and Assessment. Ensure the correct category is being used.

General obligation debt/liabilities

A general obligation debt or liability is one that is secured by a pledge of the full faith and credit of the government and its taxing power. This means that the government would be obligated to repay the debt using all available means, including raising taxes to the extent allowable by law. General obligation debt and liabilities are subject to constitutional and, for certain government types, statutory debt limits.

|

I.D. No. |

General obligation debt/liabilities |

|---|---|

|

251.11 |

Non-voted general obligation bonds, excluding those issued for certain purposes listed below |

|

251.12 |

Voted general obligation bonds, excluding those issued for certain purposes listed below |

|

251.21 |

Voted general obligation bonds for utility purposes issued by cities and towns |

|

251.22 |

Voted general obligation bonds for open space, parks, and capital facilities issued by cities and towns |

|

251.31 |

Non-voted general obligation bonds for metropolitan municipal corporations issued by counties |

|

251.32 |

Voted general obligation bonds for metropolitan municipal corporations issued by counties |

|

251.41 |

Non-voted general obligation bonds for construction issued by ports |

|

251.42 |

Non-voted general obligation bonds for airport improvements issued by ports |

|

251.43 |

Voted general obligation bonds for airport improvements issued by ports |

|

251.44 |

Voted general obligation bonds for foreign trade zones issued by ports |

|

263.51 |

Installment purchases (formally known as capital leases) - see BARS 3.4.1.80, installment-purchase agreements (e.g. rent to own), conditional sales and Certificates of Participation (COPS) other than LOCAL program financing |

|

263.56 |

Leases (see BARS 3.4.1), Subscription Based IT Arrangement (SBITA - see BARS 3.4.21) and Public-Private and Public-Public Partnership (PPP - see BARS 3.4.22) liabilities. |

|

263.61 |

Notes payable (e.g., promissory notes, Bond Anticipation Notes (BANs), Tax Anticipation Notes (TANs), Grant Anticipation Notes (GANs), etc.) |

|

263.81 |

Loans and other obligations to the federal government or other out-of-state governments |

|

263.83 |

Loans and other obligations to Washington state agencies (except LOCAL and Public Works Board loans) |

|

263.85 |

Loans and other obligations to other Washington local governments |

|

263.87 |

Public Works Board loans from the Washington Department of Commerce. |

|

263.91 |

Miscellaneous debt - report any formal debt instruments that have a specific general obligation pledge that are not properly categorized to other Debt IDs, such as mortgages or loans from banks, non-government organizations, or individuals. |

|

263.94 |

Lines of credit with a general obligation pledge |

|

263.96 |

LOCAL program financing - see BARS 3.4.11 |

|

263.98 |

Miscellaneous liabilities – report any other liability with a specific general obligation pledge within the scope of the schedule but not properly categorized under any other Debt ID. |

|

239.70 |

|

Revenue and other (non G.O.) debt/liabilities

Include in this category all obligations that do not have a specific general obligation pledge debt regardless of the fund type that is reporting this debt or liability. This category should include revenue debt, other secured debt (e.g., mortgages, etc.) and unsecured debt (e.g., compensated absences, etc.). Exclude the assessment debt. Revenue debt is secured by a pledge of revenue from a particular activity, such as a water utility. Unsecured debt and liabilities are those that do not specifically pledge an asset as collateral or revenue source for repayment. In cases where a debt or liability is secured by either a revenue or asset as well as a specific pledge of the government’s full faith and credit, the debt should be classified as general obligation using the codes listed above.

|

I.D. No. |

Revenue and other (non G.O.) debt/liabilities |

|---|---|

|

252.11 |

Non-voted revenue bonds |

|

252.12 |

Voted revenue bonds |

|

259.12 |

Compensated absences. |

|

263.12 |

Claims and judgments determined by legal judgment (such as a court order) or mutual consent. All unpaid judgments should be reported regardless of whether the government intends or is in process of appealing or settling the judgment. |

| 263.13 | Self-insurance and risk pool claims liabilities such as open claims, incurred but not reported (IBNR), unallocated loss adjustment expense (UALE). Governments with self-insurance programs should only report a liability on the Schedule 09 if they have an actuarially determined liability. |

|

263.22 |

Liabilities for landfills closure and post-closure – report balances and changes in the same amount as reported to the Department of Ecology on your financial assurance analysis annual update (as required by WAC 173-351-600, WAC 173-350 and WAC 173-304). |

|

263.40 |

Revenue warrants issued by cities pursuant to RCW 35.41.050, by ports pursuant to RCW 53.40.135, by municipal airports pursuant to RCW 14.08.118, or by water districts pursuant to RCW 57.20.027. |

|

263.52 |

Installment purchases (formally known as capital leases - see BARS 3.4.1.80), installment-purchase agreements (e.g. rent to own), conditional sales and Certificate of Participation (COPS) other than LOCAL program financing. |

|

263.57 |

Lease (see BARS 3.4.1), Subscription Based IT Arrangement (SBITA - see BARS 3.4.21) and Public-Private and Public-Public Partnership (PPP - see BARS 3.4.22) |

|

263.62 |

Notes payable (e.g., Bond Anticipation Notes (BANs), Tax Anticipation Notes (TANs), Grant Anticipation Notes (GANs), etc.) |

|

263.72 |

Arbitrage rebate tax |

|

263.82 |

Loans and other obligations to the federal government or other out-of-state governments |

|

263.84 |

Loans and other obligations to Washington state agencies (except LOCAL and Public Works Board loans) |

|

263.86 |

Loans and other obligations to other Washington local governments |

|

263.88 |

Public Works Board loans from the Washington State Department of Commerce |

|

263.92 |

Miscellaneous debt - report any formal debt instruments that do not have a specific general obligation pledge that are not properly categorized to other Debt IDs, such as mortgages, loans from banks, non-government organizations, or individuals. |

|

263.93 |

Environmental liabilities (e.g. pollution remediation, certain assets retirement, etc.) – report balances and changes in the portion to be paid by the government based on the cost estimate prepared or approved by the Department of Ecology or other federal agencies. |

|

263.95 |

Lines of credit from non-governmental sources. (lines of credit from federal, state or local governments should be reported in Debt IDs listed above). |

|

263.99 |

Miscellaneous liabilities – report any other liability within the scope of the schedule but not properly categorized under any other Debt ID (such as liabilities for when the government is more likely than not to make payments on conduit debt or financial guarantees). |

|

264.30 |

Pension liabilities – report the net pension liability amount in accordance with BARS section 3.4.13. |

|

264.40 |

OPEB Liabilities – report the actuarially determined liability for defined benefit other postemployment benefit plans in accordance with BARS section 3.4.16. |

Assessment debt/liabilities (with commitments)

An assessment debt or liability is issued by the government but secured only by revenue from taxes on a certain area, such as a Local Improvement District. Only assessment debt with commitments should be reported on the Schedule 09. If the government is obligated in some manner to assume payments on special assessment debt in the event of default by the property owners, it is assumed the government has a commitment. In cases where the debt or liability is also secured by the government’s full faith and credit, the debt should be classified as general obligation using the codes listed above.

|

I.D. No. |

Assessment debt/liabilities (with commitments) |

|---|---|

|

253.11 |

Special assessment bonds with commitments |

|

253.13 |

Road Improvement District (RID) debt |

|

253.15 |

County Road Improvement District (CRID) debt issued by counties |

|

253.43 |

Local Improvement District (LID) warrants with commitments |

|

253.63 |

Local Improvement District (LID) notes payable with commitments |

|

253.98 |

Miscellaneous assessment debt with commitments |

4.14.13.110 Instructions for preparer

List each obligation separately and its related details as listed below. All amounts should be reported as positive numbers.

Identifying Number: Include appropriate number (see the listing above).

Description: Include the identifying name, number and/or description of the debt or liability. For bonds, notes, and other loans, list each debt issue separately providing date of original issuance.

Due Date: Use this column if there is a fixed date for final payment of the liability. If there is a payable or liability in which the final payment/due date is amended or re-evaluated annually via a contract or agreement (example: DSHS advances), the beginning contract date of the new contract should be used for the due date. If there is no fixed date for final payment, this column should be left blank.

This column is required for all I.D. Numbers, except for the following:

239.70 Registered Warrants

259.12 Compensated absences

263.12 Claims and judgments

263.22 Liabilities for landfills closure and postclosure

263.51 Installment purchases (formally known as capital leases -see BARS 3.4.1.80), installment-purchase agreements (e.g. rent to own), conditional sales and COPS

263.52 Installment purchases (formally known as capital leases - see BARS 3.4.1.80), installment-purchase agreements (e.g. rent to own), conditional sales and COPS

263.56 Leases (see BARS 3.4.1), Subscription Based IT Arrangement (SBITAs - see BARS 3.4.21) and Public-Private and Public-Public Partnership (PPP - see BARS 3.4.22) liabilities

263.57 Leases (see BARS 3.4.1), Subscription Based IT Arrangement (SBITAs - see BARS 3.4.21) and Public-Private and Public-Public Partnership (PPP - see BARS 3.4.22) liabilities

263.93 Environmental liabilities (e.g. pollution remediation, certain assets retirement, etc.)

263.94 Lines of credit with a general obligation pledge

263.95 Lines of credit

263.98 Miscellaneous Liabilities

263.99 Miscellaneous Liabilities

264.30 Pension liabilities

264.40 OPEB liabilities

Beginning Balance: This column should include the amount that was owed at the beginning of this period. The amount shown should equal the last year ending balance. If there is a discrepancy, please attach an explanation. Amounts should be rounded to the nearest dollar.

Additions: In this column report the entire amount of any new debt, any additional debt issued (or borrowed) and any increase in liabilities during the current period. For example, if a G.O. bond was authorized in the previous year at $5,000,000, with $4,000,000 issued that year and an additional $500,000 issued in the report year, this column should show $500,000.

Reductions: In this column, report the amount of debt that was paid or reduction of liabilities during reported period. Do NOT include interest paid on the redeemed debt. The total amount of redeemed debt should equal payments reported on Schedule 01 (object code 70). Include here decreases due to triggering a forgiveness clause or otherwise having debt forgiven.

Note: Additions and reductions can be netted for the following liabilities: 259.12 Compensated absences, 264.40 OPEB, 263.50 Self-insurance and risk pool claims liabilities.

Ending Balance: In this column, report the amount of debt and other liabilities that were owed at the end of reported period.

Ending balance is calculated by adding Beginning Balance and Additions and subtracting Reductions.

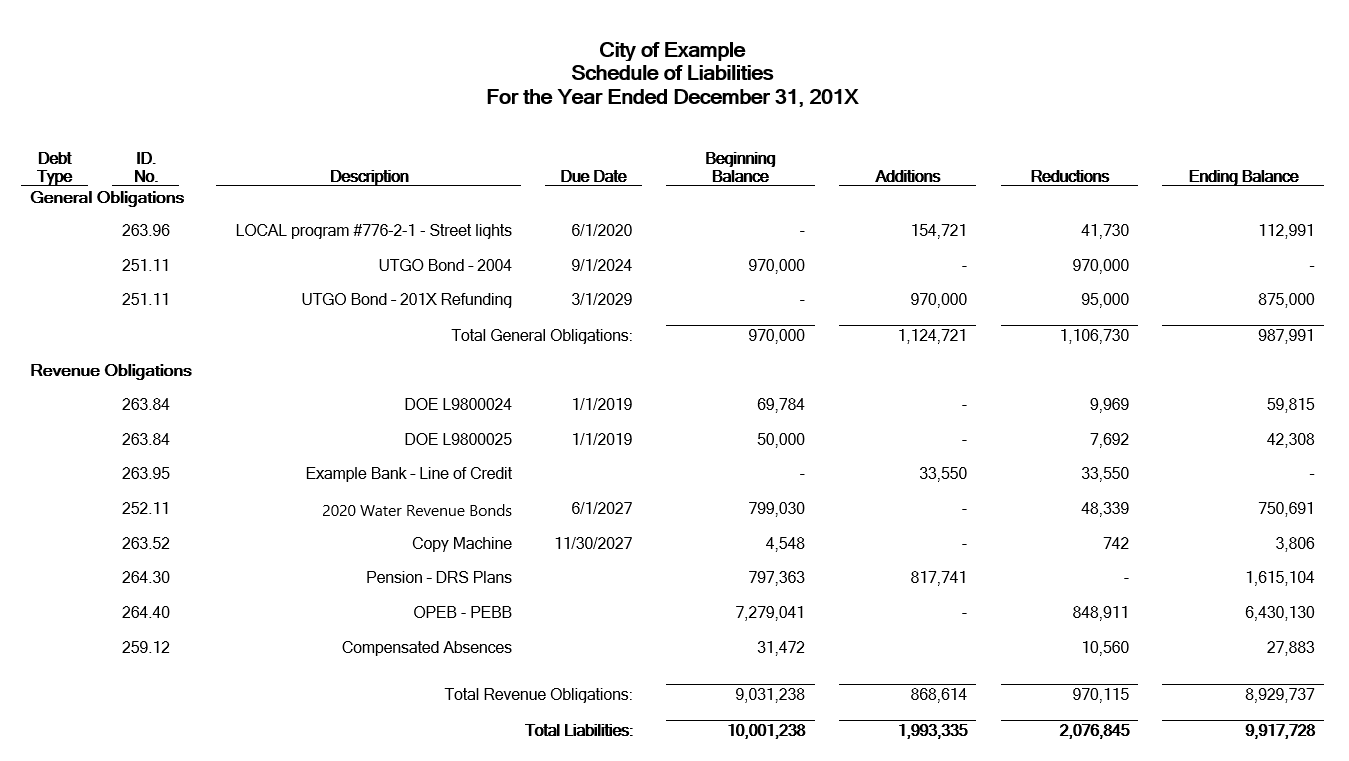

4.14.13.120 The Schedule 09 template for the filing system is available on the SAO's website page at BARS Reporting Templates. Local governments have the option to import the Schedule 09 data via the template or manually enter the data in the filing system. The following is an example of the system formatted schedule after the data is imported or manually entered.