3 Accounting

3.4 Liabilities

3.4.2 Pensions

3.4.2.10 Introduction

The guidance in sections 3.4.2.10 through 3.4.2.80 focuses mostly on local governments participating in the State of Washington cost-sharing, multiple-employer pension plans. However, the concepts are also applicable to single employer plans.

Management’s responsibilities

This guidance is intended to assist local governments in the application of pension standards. Local governments must apply their own professional judgment to determine if this guidance is appropriate for their facts and circumstances and must draw their own conclusions about the proper application of pension standards. Entity management is solely responsible for the content of the financial statements. Each local government is responsible for evaluating the information used to recognize and disclose pension amounts in its financial statements. Preparers must understand the underlying accounting and reporting concepts for pensions and retain adequate supporting documentation for all amounts reported.

Steps and procedures to calculate the proportionate share of collective pension amounts

3.4.2.30 Step 1 – Get your data

Much of the financial data necessary to report pension balances will be obtained from the State Department of Retirement Systems (DRS) at www.drs.wa.gov.

Download the Participating Employer Financial Information (PEFI) report from the Employers section of the website. This report is published annually, as of June 30, in the fall.

This report includes the Employer Allocation Schedules and the Schedules of Collective Pension Amounts for each pension plan.

Employer Allocation Schedules: Each separate plan presents a schedule of employer allocations. The schedules are sorted by allocation percentage, largest to smallest, and you will need to search each schedule for your local government’s name. Note that the PERS 1 and TRS 1 schedules have separate sections for both the regular allocation and the Plan 1 UAAL allocation. You will need both allocation percentages. If you have more than one DRS ORG ID number, you will need to combine the allocation percentages.

What is the Plan 1 UAAL?

Under RCW 41.45.060, part of the contributions for PERS 2/3, SERS 2/3, PSERS 2, and TRS 2/3 are contributed to PERS 1 and TRS 1 to fund the plans’ UAAL.

Employers have a responsibility to exercise due care in financial reporting and to verify and recalculate amounts specific to them. Use the DRS Employer Reporting Application (ERA) contribution reconciliation to verify the reasonableness of contributions used in the calculation of your proportionate share percentage. Note that the DRS calculates contributions based on the process date (the day after the transmittal date), not your reporting date. This may cause timing differences between your accounting records and the DRS.

Schedule of Collective Pension Amounts: The PEFI also includes the schedules of collective pension amounts for each plan. Employers will use the collective pension amounts and apply their proportionate share from the employer allocation schedules to determine their own share of pension amounts (i.e., net pension liability, deferred inflows/outflows). The use of this schedule is further disclosed below.

3.4.2.35 Measurement date

For all plans:

Actuarial valuations should be performed at least biennially. The valuation date can be no more than 30 months and 1 day prior to the employer’s reporting date. The pension liability should be measured as of a date (the measurement date) no earlier than the end of the employer’s prior fiscal year, consistently applied from year to year. When the valuation date is before the measurement date, update procedures must be used to roll forward the valuation to the measurement date for the employer’s reporting. There is no requirement to roll forward from the measurement date to the employer reporting date; neither is it prohibited. Professional judgment should be used to determine the specific update procedures to be used (the roll forward is usually done by the actuary).

| Earliest Available Valuation Date |

Earliest Available Measurement Date Employer Can Use |

Employer Reporting Date |

|---|---|---|

| 12/31/2021 | 6/30/2023 | 6/30/2024 |

| 2/28/2022 | 8/31/2023 | 8/31/2024 |

| 6/30/2022 | 12/31/2023 | 12/31/2024 |

For DRS plans:

On the statement of net position, local governments will report a net pension liability or asset, deferred outflows and deferred inflows for the State plans in amounts that are measured as of June 30, (the measurement date). There is no need to “roll forward” these numbers to the employer’s reporting date. This is a concession made by the Governmental Accounting Standards Board (GASB) to accommodate timely financial reporting.

Local governments with a reporting date of June 30, 2024 can use either the June 30, 2024 schedules or the June 30, 2023 schedules for their year-end balances. Local governments with a reporting date of December 31, 2024 will use the June 30, 2024 schedules for their year-end balances.

3.4.2.40 Step 2 – Calculate your numbers

See calculation templates for PERS 1, PERS 2, PSERS 2, LEOFF 1, and LEOFF 2 on the GAAP Pension Worksheet (found on the BARS Reporting Templates page).

The Schedules of Collective Pension Amounts for each plan are published near the back of the DRS report.

For each plan in which you participate, multiply the amounts in these schedules by your unique allocation percentage to calculate your entity’s share of each plan’s pension liability, deferred outflows and deferred inflows. Note that the percentages reported in the employer allocation schedules are percentages, not simple decimal amounts.

3.4.2.41 LEOFF – Special funding situation

LEOFF plans 1 and 2 include a special funding situation in which the State has a legal obligation to make contributions directly to the plans. Although the State makes the contributions, individual employers are required by GAAP to recognize pension expense and an equal amount of revenue for their share of these contributions.

LEOFF 1 is fully funded and there have been no contributions since the year 2000.

LEOFF 2: The total amount contributed by the State appears in the PEFI at the end of the LEOFF 2 Employer Allocation Schedule. Note that allocation percentages have not been calculated for individual employers and each individual employer must calculate their own share of the State’s total contributions.

Formula: From page 117 of the 2024 PEFI, State of Washington special funding allocation percentage (39.355233%) divided by total State of Washington employer allocations (60.644767%) = 64.894689%.

Example as of June 30, 2024: $1,138,148 (employers LEOFF 2 contributions) x 64.894689% = $738,598.

|

Journal Entry |

DR |

CR |

|

Pension Expense |

$738,598 |

|

|

Intergovernmental Revenue (BARS 3350301) |

$738,598 |

Employers will also use this allocation percentage to calculate the State’s proportionate share of the net pension asset associated with the individual employer for their note disclosures.

Example as of June 30, 2024: $33,162,907 (employer’s LEOFF 2 asset) x 64.894689% = $21,520,965 (State’s proportionate share of the net pension asset associated with the employer).

Contributions are no longer made to LEOFF 1 and so employers need only disclose in the notes the State’s proportionate share of the net pension asset associated with the employer.

Formula: From pages 107 of the 2024 PEFI, State of Washington special funding allocation percentage (87.12% divided by total State of Washington employer allocations (12.88%) = 676.397516%.

Example as of June 30, 2024: $5,049,107 (employer’s LEOFF 1 asset) x 676.397516% = $34,152,035 (State’s proportionate share of the net pension asset associated with the employer).

Note: These calculations do not apply to Ports nor institutions of higher education because their contribution rates already include the state contribution per RCW 41.26.450.

3.4.2.45 Overview of journal entries

Annual pension expense is not the cash contributions made to the plans. Contributions are a reduction of the pension liability. The pension accounting standards do not change statutory contribution rates or cash flow and we recommend that you do not change the way payments to the DRS are recorded in your accounting system. You may want to consider the use of a “contra” account in your accounting system to accumulate all of the debits and credits to pension expense that result from pension journal entries.

3.4.2.60 Step 3 – Year-end balances: journal entries for ending balances of collective pension amounts

See calculation templates for PERS 1, PERS 2, PSERS 2, LEOFF 1, and LEOFF 2 on the GAAP Pension Worksheet (found on the BARS Reporting Templates page).

You must perform these calculations for each plan in which you participate.

Note for local governments with a June 30 year end. These instructions assume that entities with a June 30 year end will use the June 30, 2023 PEFI and defer contributions from July 2023 through June 2024 (12 months). However, you have the option of using the June 30, 2024 PEFI with no deferral of contributions, if available in time to meet your SAO reporting requirements. Once a measurement date is selected (current vs. one year prior) local governments should not switch back and forth between the two dates over the years. This would be a change in accounting principle that would require a restatement of prior periods. When making your selection for the measurement date, keep in mind that there is no guarantee the current year’s PEFI will be available by your annual report deadline.

3.4.2.62 Deferred outflows/inflows

The following collective deferred outflows and inflows of resources are determined at the plan level:

- Net difference between projected and actual investment earnings on pension plan investments – amortized over five years

- Differences between expected and actual experience – amortized over the average expected remaining service lives of plan participants (amortization period provided by the DRS)

- Changes in actuarial assumptions – amortized over the average expected remaining service lives of plan participants (amortization period provided by the DRS)

Local governments will use their allocation percentages to calculate their individual proportionate shares of these deferred outflows and inflows. They will be amortized over the recognition periods published by the DRS in the PEFI.

There are two types of deferred outflows and inflows that must be calculated by individual employers:

- Employer’s contributions subsequent to the plan measurement date and up to the end of the employer’s reporting period must be reported as a deferred outflow of resources. State of Washington plans have a June 30 measurement date. Employers with a December 31 year end will defer the last six months of contributions. Due to the timing of the plan’s financial reports, employers with a June 30 year end will defer 12 months. These amounts are reversed in the following year when the new year-end amounts are deferred. For your calculations, use actual contributions to the plans. Contributions from PERS 2/3, SERS 2/3, and PSERS that go to PERS 1 should be reported as PERS 1 contributions.

- Changes in proportionate share and differences between actual employer contributions and proportionate share of contributions – amortized over the average expected remaining service lives of plan participants (amortization period provided by the DRS). The DRS uses actual contributions to determine proportionate share, and so differences between actual employer contributions and the proportionate share of contributions is expected to be rare. However, an employer’s proportionate share of each plan’s collective liability and deferred outflows/inflows is expected to change each year. The effect of that change should be calculated at the beginning of the period.

3.4.2.63 Restricted net position

All plans with a net pension asset should have a corresponding restricted net position. There are three methods for calculating the restricted net position related to each individual pension plan’s net pension asset.

(1) SAO’s preferred method

The restricted net position is equal to the net pension asset, minus the deferred inflows, plus the deferred outflows. Only include the deferred inflows and deferred outflows for the pension plans that have a net pension asset.

(2) GASB’s preferred method (GFOA Award Program preferred method)

The restricted net position is equal to the net pension asset. Both deferred inflows and deferred outflows are excluded from the calculation.

(3) Final option

The restricted net position is equal to the net pension asset minus deferred inflows. Only include the deferred inflows for the pension plans that have a net pension asset. Deferred outflows are excluded from the calculation.

The method selected for the calculation of restricted net position should be consistent from year-to-year and should be disclosed in the Notes to the Financial Statements, Note 1 – Summary of Significant Accounting Policies.

3.4.2.65 Change in proportionate share

If there is a change in proportion of the collective net pension liability since the prior measurement date, the net effect of that change on the employer’s proportionate shares of the collective net pension liability and collective deferred outflows of resources and deferred inflows of resources should be recognized in the employer’s pension expense, beginning in the current reporting period, using a systematic rational method over a closed period (expected remaining service lives).

The DRS will maintain and publish the amortization schedules for the collective deferred outflows/inflows (see the June 30 Participating Employer Financial Report). Individual employers must maintain their own amortization schedules for the deferred outflows/inflows that result from the changes in proportionate share. Note that the PERS 1, TRS 1, and LEOFF 1 have a recognition period of one year, as of the beginning of the measurement period. As a result, all changes in proportion for these plans are expensed in the current year with no need to amortize.

See the calculation of changes in proportionate share and amortization schedules on the GAAP Pension Worksheet (found on the BARS Reporting Templates page).

The provisions of GASB statements need not be applied to immaterial items. Governments may consider adopting an amortization threshold for their deferred outflows/inflows related to pensions. For example, amounts less than $500 could be expensed in the current year rather than amortized over many years.

3.4.2.67 Allocation of pension amounts to funds and activities

The pension accounting standards do not mention specific requirements for allocation of pension-related amounts to individual funds. However, basic governmental accounting principles (see GASB Codification of Governmental Accounting and Financial Reporting Standards (Cod.) Section (Sec.) 1500 “Reporting Liabilities”) require that long-term liabilities that are directly related to and expected to be paid from proprietary-type funds be reported in those funds.

You should allocate the net pension liability, deferred outflows/inflows, and pension expense among governmental vs. business-type activities and individual proprietary-type funds. The SAO does not prescribe any particular method. However, entities should consider a method similar to that prescribed by GASB Cod. Sec. P20 “Pension Activities – Reporting for Benefits Provided through Trusts That Meet Specified Criteria” for cost-sharing plans – “based on the manner in which contributions are assessed.” For example, allocating to funds and activities based on their proportionate share of actual employer contributions to the plan (employee contributions should not be included):

|

Contributions by Fund: |

||

|

Governmental Funds |

765 |

60% |

|

Utility Fund |

385 |

30% |

|

IS Fund |

125 |

10% |

|

1,275 |

100% |

Many local governments with a PERS 1 liability do not have PERS 1 employees. We recommend you use your PERS 2 contributions to make the allocation. Other methods may also be acceptable based on individual facts and circumstances. The allocation methodology used by the local government should be disclosed in the notes to the financial statements.

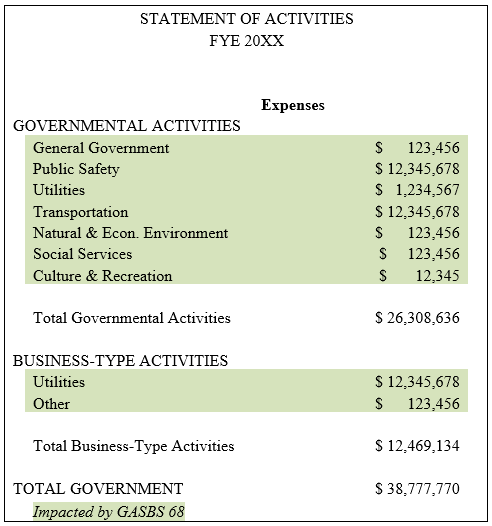

In the statement of activities, pension expense for governmental activities should be further allocated by function. Pension liability, deferred outflows/inflows, and pension expense should be reported in each applicable proprietary fund.

3.4.2.80 Note disclosures and Required Supplementary Information

Note disclosures for State Sponsored Plans are available at Note X – Pensions – State Sponsored Plans.

RSI instructions are available at BARS 4.7.3 Pension Plan Information.

3.4.2.90 Non-governmental pension plans

The accounting and financial reporting standards for non-governmental defined benefit pension plans are established in the GASB Cod. Sec. P20, portion on Defined Benefit Pensions Provided through Pension Plans That Have the Characteristics in Paragraph 112.

Some local governments may provide pensions to their employees through a cost-sharing, multiple-employer defined benefit pension plan that:

(1) is not a state or local governmental plan,

(2) is used to provide defined benefit pensions to both employees of state or local governmental employers, and

(3) has no predominant state or local governmental employer (either individually or collectively with other state or local governmental employers that provide pensions through the plan).

A union sponsored pension plan is an example of a plan meeting these criteria. Participating employers report no pension liability, deferred outflows, or deferred inflows. Pension expense is equal to contributions to the plan.

Note disclosures for defined benefit plans are at Note X – Pension and/or OPEB Plans – Nongovernmental Plans. The only RSI required is a ten-year schedule of employer contributions.

For employers who contribute to non-governmental defined contribution plans, see Note X – Pension and/or OPEB Plans - Defined Contribution.

3.4.2.100 Local government pension plans – defined benefit vs defined contribution plans

Defined benefit pensions are those for which the income or other benefits that the employee will receive at or after separation from employment are defined by the benefit terms. The pensions may be stated as:

- A specified dollar amount

- An amount that is calculated based on one or more factors such as age, years of service, and compensation

- All plans that do not meet the criteria to be a defined contribution plan are treated as a defined benefit plan

Examples of local government defined benefit plans include pre-LEOFF police and firefighters pension plans are established under the following RCWS:

- Chapter 41.16 RCW – Firefighters’ Relief and Pensions – 1947 ACT

- Chapter 41.18 RCW – Firefighters’ Relief and Pensions – 1955 ACT

- Chapter 41.20 RCW – Police Relief and Pensions in First Class Cities

Governments will need to obtain an actuarial valuation for these plans. Annually, at year-end, employers adjust the pension liability and the related deferred outflows and deferred inflows to actual as of the measurement date per the valuation. Also, adjust for payments subsequent to the measurement date. The net difference is an adjustment to pension expense.

DR/CR – Adj. pension liability and relevant DO/DI to actual per measurement date

DR/CR – Net change to pension expense

Defined contribution plans are those that:

(1) provide an individual account for each employee;

(2) define the contributions that an employer is required to make (or the credits that it is required to provide) to an active employee’s account for periods in which that employee renders service;

(3) provide that the pensions an employee will receive will depend only on the contributions (or credits) to the employee’s account, actual earnings on investments of those contributions (or credits), and the effects of forfeitures of contributions (or credits) made for other employees, as well as pension plan administrative costs, that are allocated to the employee’s account.

For defined contribution plans, there is no liability (other than amounts payable to the plan), deferred outflows, or deferred inflows to report. Pension expense is the net amount of employer contributions made to the plan.

If a government contributes to a defined contribution plan, including pension plans administered by non-government entities (such as union sponsored plans), the governments must include the plan in their note disclosures, see Note X – Pension and/or OPEB Plans – Defined Contribution

If a government does not contribute to the pension plan (only employees make contributions) governments are not required to include the plan in their pension note disclosures.

3.4.2.110 Qualifying vs. non-qualifying trusts

Depending upon how individual local governments have established their OPEB plans (including pre-LEOFF I police and firefighter plans), they may or may not meet the criteria of a trust described below. Local governments that have these plans should carefully review all legislation establishing and modifying the plans and consult with their legal counsel regarding the status of the plans.

The three criteria to meet the accounting definition of a trust are:

a. Contributions from employers to the pension plan and earnings on those contributions are irrevocable. Irrevocability is understood to mean that an employer no longer has ownership or control of the assets, except for any reversionary right once all benefits have been paid. Assets may flow from an employer to the plan, but not from the plan to an employer unless and until all obligations to pay benefits in accordance with the plan terms have been satisfied by payment or by defeasance with no remaining risk regarding the amounts to be paid or the value of plan assets. Refunds of the non-vested portion of employer contributions that are forfeited by plan members are consistent with this criterion.

b. Pension plan assets are dedicated to providing pensions to plan members in accordance with benefit terms. The use of pension plan assets to pay plan administrative costs or to refund plan member contributions is consistent with this criterion. The commingling of pension and OPEB assets in the same trust is not consistent with this criterion.

c. Pension plan assets are legally protected from the creditors of employers, the plan administrator and plan members.

Pay-as-you-go funding is not a qualifying trust.

Plans administered through a qualifying trust report “net pension liability” because there is fiduciary net position (in the trust) to net against the total pension liability. The entire net pension liability is a non-current liability.

Plans not administered through a qualifying trust report “total pension liability” because there are no plan assets or fiduciary net position. The “total pension liability” should be allocated between current and non-current liabilities in the financial statements. Since there is no trust fund to make the benefit payments, the employer is making the payments. So the amounts expected to be due within one year are current liabilities.

For GAAP statements that include multiple opinion units, the pension liability, and deferred outflows and deferred inflows related to pension, should be allocated between governmental and business-type activities in the government-wide statement of net position. Pension expense should be allocated to the appropriate activities in the government-wide statement of activities. For proprietary, pension amounts should be reported in the specific funds they are related to and expected to be paid from. Pension amounts, other than actual payments, should not be reported in governmental-type funds.

3.4.2.111 Fiduciary Fund Financial Statements

- Qualifying trusts – If the plan is administered through a qualifying trust, then the government is holding monies on behalf of someone else, which requires fiduciary reporting. The employer should report a statement of fiduciary net position (examples of reportable items: cash/investments set aside to pay benefits. Liabilities are only reported when the government is compelled to disburse the resources when no further action, approval, or condition is required to be taken or met by the beneficiary to release the resources) and a statement of changes in fiduciary net position (examples of reportable items: contributions from the employer/government, contributions from employees, investment earnings, benefit payments made) for the plan. The net pension liability is a liability of the employer, not the plan. Since the pension liability is reported in the government-wide statements, and proprietary fund statements, it should not be reported in the fiduciary statements.

- No qualifying trust – When there is no qualifying trust, the employer cannot report a trust. There should be no fiduciary fund statements presented for the plan. Any assets accumulated in a fund should be reported as assets of the employer. In these circumstances, any OPEB fiduciary funds should be treated as managerial funds and rolled into the appropriate fund (e.g., the general fund) for financial statement reporting.

3.4.2.112 Accounting for Pension Taxes and Fiduciary Trust Funds

Some governments receive taxes to help fund pension costs, such as the Fire Insurance Premium Tax (BARS 336.06.91) or an ad valorem property tax for pensions. These taxes are levied by the government, not the pension plans. Since these are revenues of the government, they must be reported as a revenue in the governmental funds. To move these monies to the fiduciary trust fund, they would then report an expenditure in the governmental fund and then report an addition in the fiduciary trust fund.

For example, a government receipts $50,000 in Fire Insurance Premium Tax that will ultimately be used in their fiduciary trust fund to pay pension benefits. They would make the following journal entries:

Initial receipt of tax money:

|

General Fund – Cash |

$50,000 |

|

|

General Fund – Fire Insurance Premium Tax (BARS 336.06.91) |

|

$50,000 |

Move tax money out of General Fund:

|

General Fund – Expenditure (BARS 517.20.20) |

$50,000 |

|

|

General Fund – Cash |

|

$50,000 |

Move tax money into Fiduciary Trust Fund:

|

Fiduciary Trust Fund – Cash |

$50,000 |

|

|

Fiduciary Trust Fund – Additions (BARS 389.40) |

|

$50,000 |