Note X – OPEB Defined Benefit Plan – No Qualifying Trust

A template for this note is not available. See “Instructions to preparer:” for disclosures that may be required.

Instructions to preparer:

The instructions below assume the plan is not administered through a qualifying trust and there is no special funding situation. See Governmental Accounting Standard Board (GASB) Codification of Governmental Accounting and Financial Reporting Standards (Cod.) Section (Sec.) “Postemployment Benefits Other Than Pensions – Reporting for Benefits Not Provided through Trusts That Meet Specified Criteria – Defined Benefit.”

If applicable, the notes should separately identify amounts for the primary government (including blended component units) from amounts for discretely presented component units.

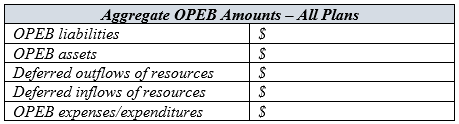

Aggregate OPEB Amounts

There should be one table that reports the aggregate amounts for all plans, regardless of the type of OPEB plan and whether or not it is administered through a qualifying trust. OPEB assets would be relevant only for plans that are administered through a qualifying trust.

Example:

The following table represents the aggregate OPEB amounts for all plans for the year 20XX:

The remaining required disclosures should be made for each OPEB plan in which the employer participates. Disclosures related to more than one OPEB plan should be combined in a manner that avoids unnecessary duplication.

OPEB Plan Description

a. The name of the OPEB plan, identification of the entity that administers the OPEB plan, and identification of the OPEB plan as a single-employer or multiple-employer defined benefit plan.

b. A brief description of the benefit terms, including (1) the classes of employees covered; (2) the types of benefits; (3) the key elements of the OPEB formulas; (4) the terms or policies, if any, with respect to automatic postemployment benefit changes, including automatic COLAs, and ad hoc postemployment benefit changes, including ad hoc COLAs, and the sharing of benefit-related costs with inactive employees; and (5) the authority under which benefit terms are established or may be amended. If the OPEB plan is closed to new entrants, that fact should be disclosed.

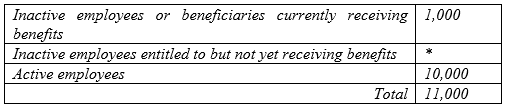

c. The number of employees covered by the benefit terms, separately identifying numbers of the following: (1) Inactive employees currently receiving benefit payments (2) Inactive employees entitled to but not yet receiving benefit payment [1] (3) Active employees. Note: “inactive employee” = retiree.

Example:

Employees covered by benefit terms: At December 31, 20XX, the following employees were covered by the benefit terms:

| Inactive employees or beneficiaries currently receiving benefits | 1,000 |

| Inactive employees entitled to but not yet receiving benefits | 100 [1] |

| Active employees | 10,000 |

| Total | 11,100 |

d. The fact that there are no assets accumulated in a qualifying trust. Each of the 3 qualifying criterion that the plan does not meet should be disclosed.

Example:

The plan is funded on a pay-as-you-go basis and there are no assets accumulated in a qualifying trust.

or

The plan is administered through a trust that does not meet the requirements of a qualifying trust.

(Then describe each criterion that the trust does not meet).

e. Identification of the authority under which requirements for the employer and nonemployer contributing entities, if any, to pay OPEB as the benefits come due are established or may be amended. Also, the amount paid by the employer for OPEB as the benefits came due during the reporting period, if not otherwise disclosed.

Assumptions and other inputs

Significant assumptions and other inputs used to measure the total OPEB liability, including assumptions about inflation, healthcare cost trend rates, salary changes, ad hoc postemployment benefit changes (including ad hoc COLAs), and the sharing of benefit-related costs with inactive employees, should be disclosed, as applicable. With regard to the sharing of benefit-related costs, if projections are based on an established pattern of practice, that fact should be disclosed. With regard to mortality assumptions, the source of the assumptions (for example, the published tables on which the assumptions are based or that the assumptions are based on a study of the experience of the covered group) should be disclosed. The dates of experience studies on which significant assumptions are based also should be disclosed. For all significant assumptions, if different rates are assumed for different periods, information should be disclosed about what rates are applied to the different periods of the measurement. With regard to the discount rate, the rate applied in the measurement and the source of that rate should be disclosed.

In addition, if the alternative measurement method is used to measure the total OPEB liability, the source of or basis for all significant assumptions should be disclosed.

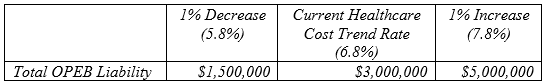

Measures of the total OPEB liability calculated using each of the following rates, should be disclosed:

a. If applicable, a healthcare cost trend rate that is 1-percentage-point higher than the assumed healthcare cost trend rate, and a healthcare cost trend rate that is 1-percentage-point lower than the assumed healthcare cost trend rate. Note: This information should come from your actuarial valuation.

Example:

The following presents the total OPEB liability of the (city/county/district) calculated using the current healthcare cost trend rate of 6.8 percent, as well as what the OPEB liability would be if it were calculated using a discount rate that is 1-percentage point lower (5.8 percent) or 1-percentage point higher (7.8 percent) that the current rate.

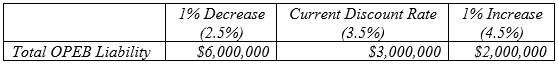

b. A discount rate that is 1-percentage-point higher than the current rate, and a discount rate that is 1-percentage-point lower than the current rate.

Note: This information should come from your actuarial valuation.

Example:

The following presents the total OPEB liability of the (city/county/district) calculated using the discount rate of 3.5 percent, as well as what the OPEB liability would be if it were calculated using a discount rate that is 1-percentage point lower (2.5 percent) or 1-percentage point higher (4.5 percent) that the current rate.

Changes in the Total OPEB Liability

For the current reporting period, a schedule of changes in the total OPEB liability should be presented.

Note: This information should come from your actuarial valuation.

| Plan Name | |

| Total OPEB Liability at 01/01/20XX_ | $ |

| Service cost | |

| Interest | |

| Changes of benefit terms | |

| *Differences between expected and actual experience | |

| *Changes of assumptions | |

| Benefit payments | |

| **Other changes | |

| Total OPEB Liability at 12/31/20XX | $ |

* If the alternative measurement method was used, you may combine the amounts for differences between expected and actual experience and changes of assumptions.

** Identify other changes separately if individually significant

In addition to the information required above, the following information should be disclosed, if applicable:

a. The measurement date of the total OPEB liability; the date of the actuarial valuation or alternative measurement method calculation on which the total OPEB liability is based; and, if applicable, the fact that update procedures were used to roll forward the total OPEB liability to the measurement date. If the alternative measurement method is used to measure the total OPEB liability, the fact that this alternative method was used in place of an actuarial valuation also should be disclosed.

b. If the employer has a special funding situation, the employer’s proportion (percentage) of the total OPEB liability, the basis on which its proportion was determined, and the change in its proportion since the prior measurement date

c. A brief description of changes of assumptions or other inputs that affected measurement of the total OPEB liability since the prior measurement date.

d. A brief description of changes of benefit terms that affected measurement of the total OPEB liability since the prior measurement date.

e. The amount of benefit payments in the measurement period attributable to the purchase of allocated insurance contracts, a brief description of the benefits for which allocated insurance contracts were purchased in the measurement period, and the fact that the obligation for the payment of benefits covered by allocated insurance contracts has been transferred from the employer to one or more insurance companies.

f. A brief description of the nature of changes between the measurement date of the total OPEB liability and the employer’s reporting date that are expected to have a significant effect on the total OPEB liability and the amount of the expected resultant change in the total OPEB liability, if known.

g. The amount of OPEB expense recognized by the employer in the reporting period.

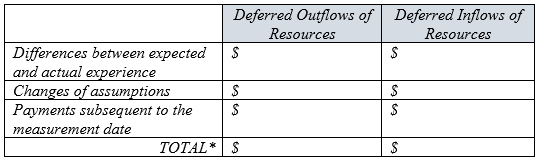

h. The employer’s balances of deferred outflows of resources and deferred inflows of resources related to OPEB, as applicable:

Note: This information should come from your actuarial valuation. Under the alternative measurement method, deferred outflows and inflows are not calculated for anything other than payments subsequent to the measurement date.

Example:

At December 31, 20XX, the (city/county/district) reported deferred outflows of resources and deferred inflows of resources related to OPEB from the following sources:

* Total should agree to amounts presented in the financial statements.

i. A schedule for each of the subsequent five years, and in the aggregate thereafter, the net amount of the employer’s balances of deferred outflows of resources and deferred inflows of resources in the table above that will be recognized in the employer’s OPEB expense.

For each of the subsequent five years, and in the aggregate thereafter, the net amount of the employer’s balances of deferred outflows of resources and deferred inflows of resources in the table above that will be recognized in the employer’s OPEB expense.

Prepare a separate table for each plan.

Example:

Deferred outflows of resources of $________ resulting from payments subsequent to the measurement date will be recognized as a reduction of the total OPEB liability in the year ended December 31, 20XX [2]. Other amounts reported as deferred outflows and deferred inflows of resources related to OPEB will be recognized in OPEB expense as follows:

| Year ended December 31: | |

| 20XX | $ |

| 20XX | $ |

| 20XX | $ |

| 20XX | $ |

| 20XX | $ |

| Thereafter | $ |

j. The amount of revenue recognized for the support provided by nonemployer contributing entities, if any.

Required Supplementary Information

See RSI requirements at RSI Other Postemployment Benefit (OPEB) Plan Schedules.

Instructions to Preparer:

[1] For PEBB plans (or other group plans not administered by the government), if you are unable to determine the number of inactive employees entitled to but not yet receiving benefits, disclose that fact.

Example:

*It is not possible to determine the number of employees entitled to but not yet receiving benefit payments. Retiring employees apply for benefits at their discretion, may be otherwise working and not eligible for benefits or be deceased. This data is not monitored by the (city/county/district), Health Care Authority or the state of Washington.

[2] This should always be the fiscal year immediately following the year that is reported in the financial statements.