Note X – Risk Pools – Solvency

This guidance applies to stand-alone risk pools and governments that manage risk pools.

A. Financial Solvency Property and Liability Pool (Joint Pools)

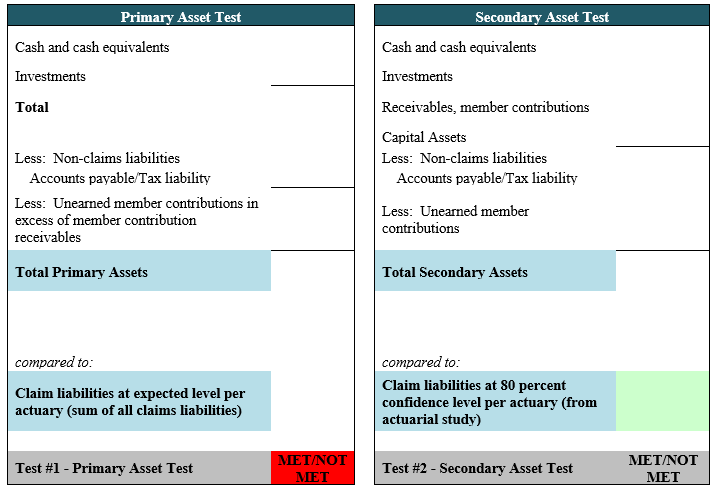

Washington Administrative Code (WAC) 200-100 requires (Pool) to maintain certain levels of primary and secondary assets to meet solvency standards. As defined in WAC 200-100-03001 total primary assets, cash and cash equivalents less non-claim liabilities, must be at least equal to the unpaid claims estimate at the expected level as determined by the actuary. Additionally, total primary and secondary assets must be at least equal to the unpaid claims estimate at the 80 percent confidence level as determined by the actuary. Secondary assets are defined as insurance receivables, real estate or other assets (less any non-claim liabilities) the value of which can be independently verified by the state risk manager.

Solvency test for program:

B. For Health and Welfare Pools (Joint Pools) [1]

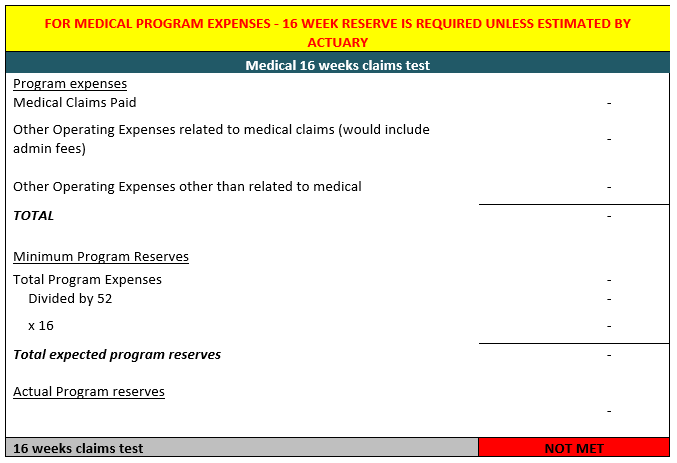

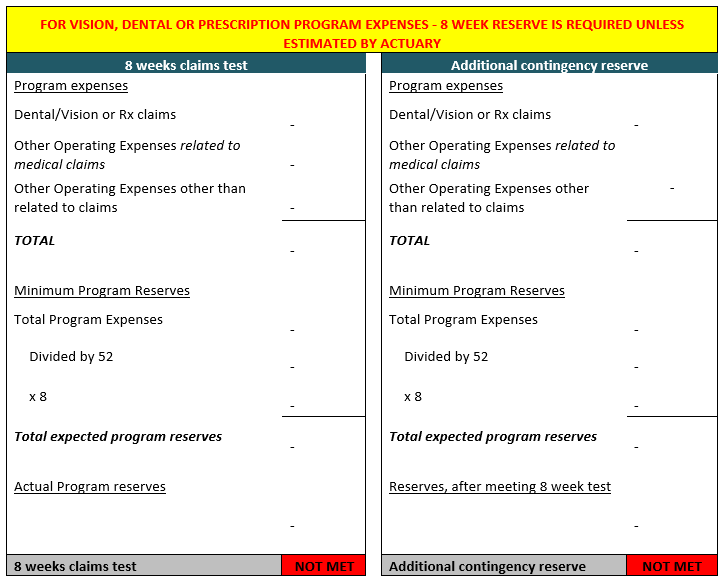

Washington Administrative Code (WAC) 200-110-040 requires all joint health and welfare programs self-insuring medical benefit programs to establish program reserves (monies set aside to pay expenses) in an amount equal to 16 weeks of program expenses. The WAC requires vision, dental and prescription drug benefit programs or any combination of programs to establish program reserves in an amount not less than eight weeks of program expenses for each program offered. An additional contingency reserve for vision, dental or prescription drug programs is also recommended, but not required.

The following note would only be included if applicable:

In lieu of the above mentioned requirements, all joint health and welfare self-insurance providing either medical, vision, dental or prescription drug benefits or any combination thereof must obtain an independent actuarial study of estimated outstanding program liabilities and maintain funds equal to or greater than the actuarially determined program liability at fiscal year-end.

Solvency test for program:

Instructions to preparer:

[1] This note should be customized specifically to the risk pool’s circumstances particularly if programs in existence less than one year have established reserves according to the initial plan submitted and approved by the state risk manager, if different than the required eight week reserve, OR if reserve is determined by obtaining an independent actuary estimate.

Return to Reference 1