4 Reporting

4.3 Fund Financial Statements

4.3.3 Governmental Funds Financial Statements

4.3.3.10 Governmental funds should be reported using the current financial resources measurement focus and the modified accrual basis of accounting.

The governments are required to provide a summary reconciliation of total governmental fund balances to net position of governmental activities in the statement of net position. The reconciliation may be presented at the bottom of the balance sheet or in an accompanying schedule. (For possible reconciling items, see BARS Manual 4.4, Conversion and Reconciliation between Government-Wide and Fund Financial Statements.)

The governments have the option to report the budgetary information in the governmental funds financial statements instead as a part of the required supplementary information.

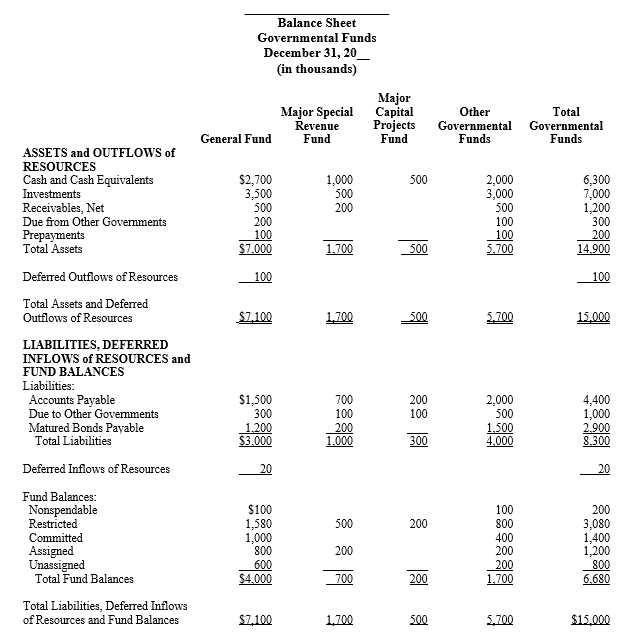

Balance Sheet

4.3.3.20 The financial information is required to be reported separately for general fund, each major governmental fund and nonmajor governmental funds in aggregate.

Current assets, liabilities, and fund balances of governmental funds should be displayed in a balance sheet using the following formula:

Current Assets = Current Liabilities + Fund Balance

General capital assets and general long-term liabilities are not reported in the governmental fund balance sheet [1].

4.3.3.30 When preparing the governmental balance sheet, remember:

- Interfund liabilities should be reported as fund liabilities regardless of their date of scheduled repayment. Interfund loans may be reported as short-term or long-term liabilities depending on their conditions. The governments should also show the reservation of the fund balance for the noncurrent interfund receivables.

- Equity interest in joint ventures should not be reported as an asset in the governmental fund balance sheet except for amounts that meet the definition of financial resources (e.g., receivable from/payable to joint venture, etc.). All equity interest should be reported in the government-wide financial statements.

- A reconciliation that shows adjustments made between the balance sheet and the government-wide statement of net position is required on the bottom of the report. See BARS Manual 4.4, Conversion and Reconciliation between the Government-Wide and Fund Financial Statements.

- If any categories of the fund balances are displayed on the face of financial statements in aggregate, the specific components and purposes must be disclosed in the notes to financial statement.

| Amounts reported for governmental activities in the statement of net position are different because: [2] | |

| Capital assets used in governmental activities are not financial resources and therefore are not reported in the funds. | 20,000 |

| Other long-term assets are not available to pay for current-period expenditures and therefore are deferred in the funds. | 4,850 |

| Internal service funds are used by management to charge the costs of certain activities, such as insurance and telecommunications, to individual funds. The assets and liabilities of certain internal service funds are included in governmental activities in the statement of net position. | 5,500 |

| Some liabilities, including bonds payable, are not due and payable in the current period and therefore are not reported in the funds. | -14,575 |

| Net position of governmental activities: | $30,675 |

| The notes to financial statements are an integral part of this statement. |

The notes to financial statements are an integral part of this statement.

4.3.3.31 Classification of fund balances

Nonspendable – These are amounts that are not in a form that can be spent because they are either not in a spendable form or they are legally or contractually required to be maintained intact. This includes items such as inventories, prepaid amounts, corpus (or principal) of a permanent fund, long-term loans and notes receivable, as well as property acquired for resale. However, if the use of the proceeds from the collection of the receivables, loans, or from the sale of properties is restricted, committed, or assigned, then they should be included in the appropriate fund balance classification (restricted, committed, or assigned), rather than nonspendable fund balance.

Restricted – These are amounts remaining from resources received from external parties that can be spent only for the specific purposes designated by external providers, constitutionally, or through enabling legislation. Restrictions are changed or lifted only with the consent of resource providers. External resource providers could include creditors, grantors, and donors.

Committed – These are amounts remaining from resources received that can only be used for the specific purposes determined by a formal action (ordinance or resolution) of a government’s highest level of decision-making authority. Changing or removing a commitment requires taking the same formal action that originally imposed the constraint.

Assigned – These are amounts intended to be used by the government for specific purpose that are neither restricted nor committed. Intent can be expressed in one of two ways:

- The governing body can state its intent to use resources for a specific purpose

- The governing body can delegate authority to others to express intent to use amounts for specific purposes.

Assigned amounts include all the remaining amounts (except for negative balances) that are reported in special revenue, capital project, debt service, or permanent funds that have not been designated as restricted or committed.

Assigned amounts in the general fund represent funds that are intended to be used for a specific purpose as stated by the governing body or its delegate.

Unassigned – This is the amount remaining in the fund after classifying amounts as nonspendable, restricted, committed, or assigned. Unassigned amounts are technically available for any purpose. The General Fund is the only fund that will have a positive unassigned fund balance.

Emergency Funds, Savings Accounts, and Rainy Day Funds

4.3.3.32 To be reported as committed funds set aside for use in emergency situations, revenue shortages, budgetary imbalances, or other similarly intended arrangements must have formal action by the governing body which imposed parameters for spending. The parameters should identify and describe the specific circumstances under which a need for spending arises. The detailed circumstances should be such that they would not be expected to occur routinely. For example, a stabilization amount that can be accessed “in an emergency” would not qualify to be classified within the committed category because the circumstances or conditions that constitute an emergency are not sufficiently detailed, and it is not unlikely that an “emergency” of some nature would routinely occur. For the purpose of classifying these arrangements as committed fund balance, the formal action should be sufficiently detailed and include what the funds can be spent on, how the funds will be replenished if spent, when the funds can be spent, and why the funds can be spent (the event that must occur for the funds to be spent).

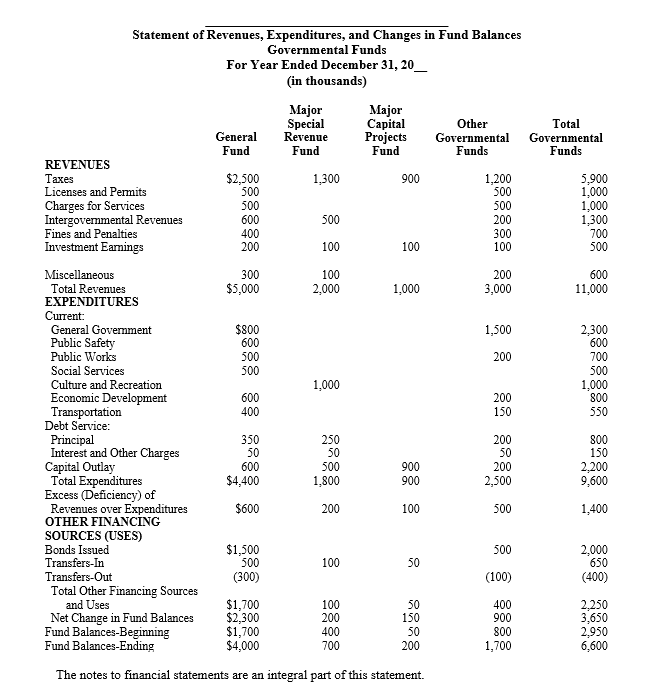

Statement of Revenues, Expenditures, and Changes in Fund Balances

4.3.3.40 The governmental fund statement of revenues, expenditures, and changes in fund balances reports information about the inflows, outflows, and balances of current financial resources of each major governmental fund and for the nonmajor governmental funds in the aggregate. There is one permitted format for the statement.

4.3.3.50 When preparing the governmental statement of revenues, expenditures and changes in fund balances, remember:

- Governmental fund revenues should be classified by major revenue source (taxes, licenses and permits, etc.); expenditures – by function (e.g., general government, public safety, etc.). However, the governments can report additional details on the statement.

- Debt issue costs paid out of either debt proceeds or from existing resources should be reported as expenditures. The face amount of the debt should be reported as other financing sources and debt premiums or discounts should be shown as a separate component of Other Financing Sources (Uses).

- Payments to escrow agents for bond refunding from the proceeds of the refunding (new) debt should be reported separate category in Other Financing Sources (Uses).

- Sales of assets (unless they are considered a special item) and transfers should be also shown as separate categories in Other Financing Sources (Uses).

- Extraordinary and special items should be separated on the bottom of the statement. For more details see BARS Manual 4.2.2, Statement of Net Position.

- A reconciliation that shows adjustments made between the statement of revenues, expenditures, and changes in fund balances and the government-wide statement of net position, is required on the bottom of the report. See BARS Manual 4.4, Conversion and Reconciliation between the Government-Wide and Fund Financial Statements.

4.3.3.60 The governments are required to provide a summary reconciliation between total change in governmental fund balances and the change in net position in governmental activities in the statement of net position. The reconciliation may be presented at the bottom of the statement of revenues, expenditures, and changes in fund balances or in an accompanying schedule. (For possible reconciling items, see BARS Manual 4.4, Conversion and Reconciliation between Government-Wide and Fund Financial Statements.)

Footnotes

[1] They are reported only on the government-wide financial statements.

Return to Reference 1

[2] For more details see Conversion and Reconciliation between Government-Wide and Fund Financial Statements.

Return to Reference 2