4 Reporting

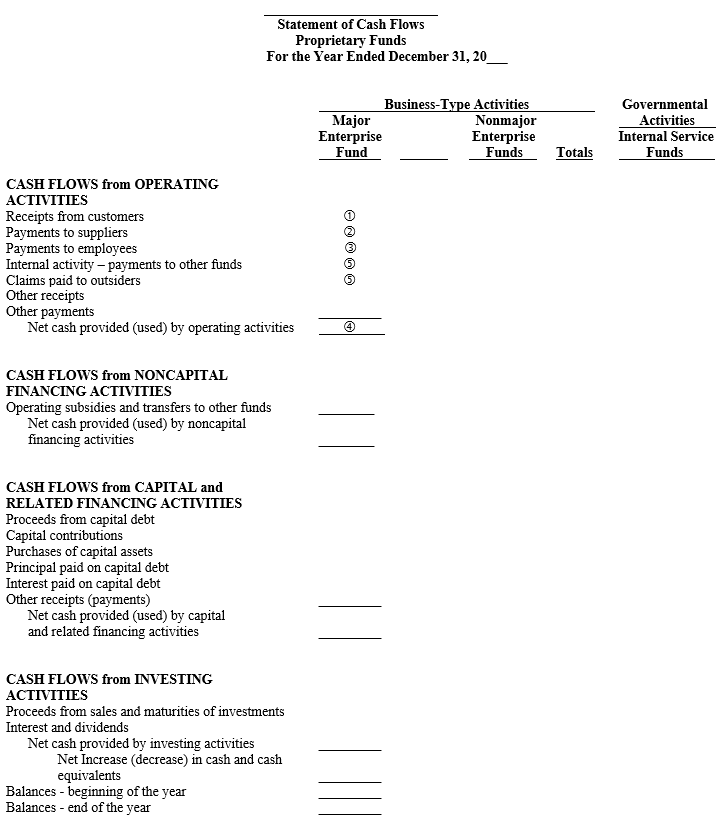

4.5 Statement of Cash Flows

4.5.10 The government must present a statement of cash flows for proprietary funds. The only acceptable method of presentation is the direct method. In using the direct method, a reconciliation of operating cash flows to operating income is required.

4.5.20 GAAP requires cash flow activity from blended component units to be presented on the statement of cash flows; however, the statement should not contain cash flow activity from discretely presented component units.

4.5.30 The statement of cash flows reports the flow of cash in four activities:

- Cash Flows from Operating Activities

- Cash Flows from Noncapital Financing Activities

- Cash Flows from Capital and Related Financing Activities

- Cash Flows from Investing Activities

Cash Flows from Operating Activities

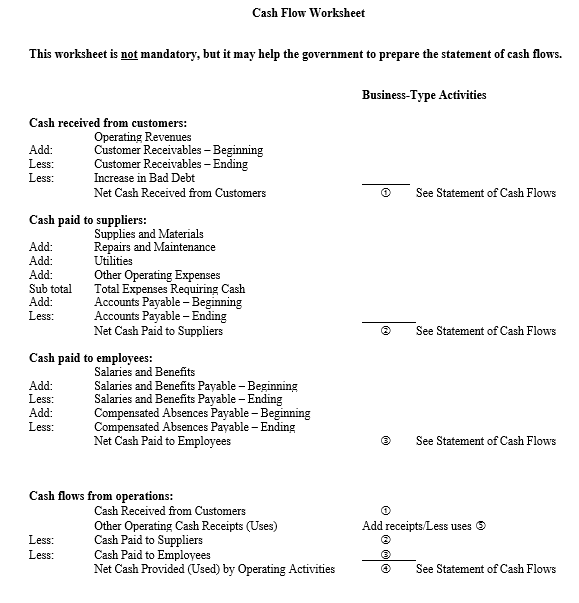

4.5.40 In reporting cash flows from operating activities, governments should report major classes of gross cash receipts and gross cash payments and their sum – the net cash flow from operating activities. Cash flows from operations include all cash related to transactions and events reported as components of operating income in the statement of revenues, expenses, and changes in fund net position. In addition, the operating activities category is used for any cash inflow or outflow that cannot properly be classified in one of the other three categories. Governments should, at a minimum, report separately these classes of operating cash receipts and payments:

- Cash receipts from customers

- Cash receipts from interfund services provided

- Other operating cash receipts (if any)

- Cash payments to employees for services

- Cash payments to other suppliers of goods or services

- Cash payments for interfund services used, including payments in lieu of taxes that are payments for, and reasonably equivalent in value to, services provided

- Other operating cash payments (if any)

4.5.50 The cash flows for cash receipts from customers, cash paid to employees and suppliers (item a, d and e above) may be difficult to determine, so the governments may indirectly calculate these amounts. (See the worksheet at the end of this section.)

4.5.60 Further detail of operating cash receipts and payments should be provided if the detail is useful. Interest receipts usually do not qualify to be a part of cash flows from operating activities. Exceptions to this rule are loans that:

- Fulfill government social programs rather than for income or profit; and

- Directly benefit individual constituents of government.

4.5.70 Program loans typically refer to loans that meet both of these exceptions. The collection of principal payments related to program loans is reported as a cash inflow in this section.

Cash Flows from Noncapital Financing Activities

4.5.80 This portion of the cash flows statement includes:

- Borrowing and repayments (principal and interest) of debt that is not clearly attributable to capital purposes. Capital purposes include capital acquisition, construction, or improvement, including capital lease repayments.

- Borrowings to finance program loans.

- Grant proceeds not specifically restricted to capital purposes.

- Grant payments (both capital and otherwise) to other governments.

- Transfers to and from other funds (except when a transfer is received for capital purposes).

- Tax receipts not attributable to capital purposes.

- Interest paid on noncapital-related vendor payables.

Cash Flows from Capital and Related Financing Activities

4.5.90 This portion of the cash flows statement includes:

- Borrowing and repayment (principal and interest) of debt clearly attributable to capital purposes.

- Proceeds of capital grants and contributions.

- Transfers from other funds for capital purposes.

- Payments related to the acquisition, construction, or improvement of capital assets.

- Sale or involuntary conversion of capital assets (such as insurance proceeds resulting from the loss of a capital asset).

- Capital-type special assessments.

- Tap fees in excess of the actual cost of connection (if they are to be used for capital purposes).

- Taxes levied specifically for capital purposes or related debt service.

Cash Flows from Investing Activities

4.5.110 This portion of the cash flows statement includes:

- Receipt of interest (except on certain program loans).

- Loan collections (except for certain program loans).

- Proceeds from the sale of investments.

- Receipt of interest on customer deposits.

- Changes in the fair value of investments subject to fair value reporting and classified as cash equivalents.

- Cash outflows in the investing activities category include:

- Loans made to others (except for program loans).

- Purchase of investments.

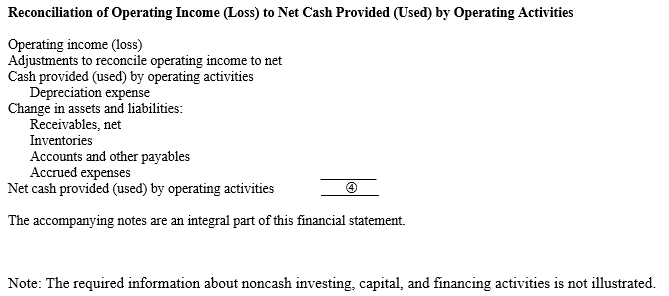

Reconciliation

4.5.120 Governments are required to provide a reconciliation of the difference between cash flows from operating activities and operating income. This reconciliation should be presented either within the statement of cash flows or as an accompanying schedule to the statement.

Noncash investing, capital, or financing transactions

4.5.130 The statement of cash flows is limited to actual inflows and outflow of cash (and cash equivalents). Therefore, financial statement users still need information on certain noncash activities that otherwise would fail to be reported either in the statement of revenues, expenses, and changes in fund net position or in the statement of cash flows. Specifically, information is needed regarding noncash transactions that meet two criteria:

- The transaction affects recognized assets or liabilities, and

- The transaction would not properly have been classified as cash flows from operating activities.

This information can be presented either in a narrative or tabular format on a separate schedule accompanying the statement of cash flows.