4 Reporting

4.8 SAO Annual Report Schedules

4.8.6 Public Works − Cities and Counties (Schedule 17)

| Quick Links |

| Instructions for cities |

| Instructions for counties |

Schedule instructions for cities

4.8.6.10 This Schedule applies to first class cities (RCW 35.01.010). The purpose of this Schedule is to document compliance with limitations on public works projects performed by public employees as described in RCW 35.22.620(2)(4).

Instructions for individual lines:

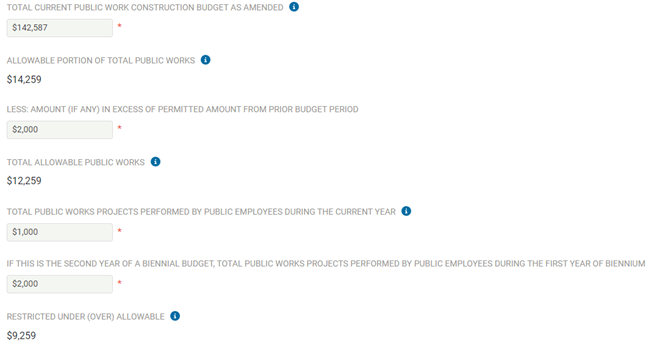

1. Record the total current public work construction budget, including any amendments.

2. This amount is 10 percent of line 1. RCW 35.22.620(2) sets this limitation on public works projects performed by public employees. The filing system will automatically calculate the amount for the limitation.

3. Subtract the amount, if any, that was in excess of the permitted amount in the prior budget period.

4. The filing system will automatically calculate the amount allowed by statute for public works performed by public employees for the current year (which calculates the difference in line 2 and line 3).

5. Record the total construction costs of public works performed by public employees for the year being reported. Be sure to include work performed for the city by a county.

6. This line is only pertinent to cities that budget on a biennial basis. For those municipalities, record on this line total construction costs of public works performed by public employees for the first year of biennium. If this line does not apply to you, enter “0” into the field.

7. This amount is the difference between the statutory limit computed on line 4 and the amount of public works performed by public employees recorded on lines 5 and 6. A negative number here indicates noncompliance with the limitations and must be carried forward to next budget period report. If this noncompliance is not corrected within two years, 20 percent of the motor vehicle fuel tax will be withheld (RCW 35.22.620(2)). This amount is automatically calculated in the filing system.

4.8.6.11 The Schedule should be prepared on the same basis of accounting, for the same period and reporting entity, and using the same underlying accounting records as the Schedule 01 and financial statements.

4.8.6.15 The Schedule must be completed within the annual filing system. The line items that require a calculation will automatically be calculated within the filing system. The following is an example of the fields required for this Schedule.

NOTE: If the restricted amount is over allowable, this amount must be carried forward to next budget period report.

Schedule instructions for counties

Part 1. Public Works Projects Performed by Public Employees

4.8.6.20 This part applies to counties that established purchasing departments and use public employees to perform public works projects (RCW 36.32.240(1), RCW 36.32.235).

4.8.6.30 The amount reported should include all public work, including county road construction. Public work is defined in RCW 39.04.010. For additional reporting requirements for county road construction projects, see Part 3 below.

4.8.6.40 Note: For counties with a purchasing department, due to changes removing the population requirement in RCW 36.32.235 effective in fiscal 2019 and possible conflicts with RCW 36.32.240, we would expect the county to consult with their legal counsel regarding the use of day labor and applicable limits. ALL counties are subject to limits for the county roads construction projects (RCW 36.77.065). See Part 3 of this Schedule for reporting requirements.

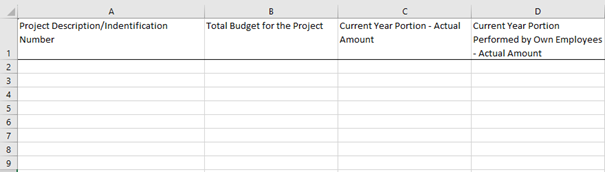

The template for the annual filing system to upload the information required for Part 1 is available on the SAO’s website at BARS Reporting Templates. The following is an example of the template.

Part 2. Limitations on Public Works Projects Performed by Public Employees

4.8.6.50 This part applies only to counties which by resolution established a county purchasing department (RCW 36.32.240(1), RCW 36.32.235(8)).

Part 2 of the Schedule must be completed within the annual filing system. You will need to check the box in the filing system if Part 2 is applicable to your county. The line items that require a calculation will automatically be calculated within the filing system.

Instructions for individual lines:

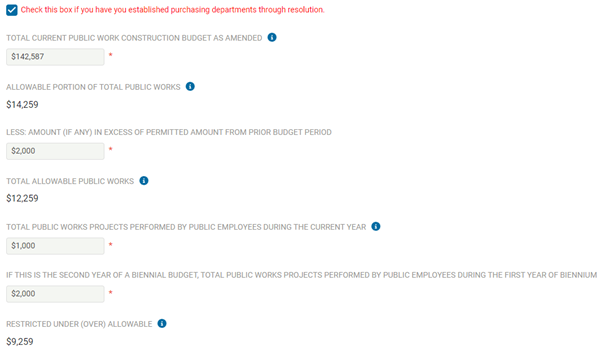

1. Record the total current public work construction budget, including any amendments, from Part 1.

2. The filing system will automatically calculate the amount for the allowable portion of public projects performed by public employees. RCW 36.32.235(8) sets this limitation at 10 percent of line 1.

3. Subtract the amount, if any, that was in excess of the permitted amount in the prior budget period.

4. The filing system will automatically calculate the amount for the limitation on public works performed by public employees for the current year (line 2 less line 3).

5. Record the total construction costs of public works performed by public employees for the year being reported, from Part 1.

6. This line is only pertinent to counties that budget on a biennial basis. For those counties, record on this line total construction costs of public works performed by public employees for the first year of biennium. If this line does not apply to you, enter “0” into the field.

7. The filing system will automatically calculate the difference between the statutory limit computed on line 4 and the amount of public works performed by public employees recorded on lines 5 and 6. A negative number here indicates noncompliance with the limitations and must be carried forward to next budget period report. If this noncompliance is not corrected within two years, 10 percent of the motor vehicle fuel tax will be withheld (RCW 36.32.235(10)).

The following is an example of the fields required for this Schedule that is completed within the filing system.

NOTE: If the amount of public works performed by public employees is over allowable, this amount must be carried forward to next budget period report.

Part 3. Limitations on County Roads Construction Projects Performed by Public Employees

4.8.6.60 This part applies to ALL counties (RCW 36.77.065). Counties are required to prepare and have available for an audit the Annual Construction Program and the Annual Construction Report forms, required by the County Road Administration Board, pertaining to the same calendar year.

Access to blank forms is at www.crab.wa.gov.