4 Reporting

4.3 Fund Financial Statements

4.3.5 Fiduciary Funds Financial Statements

4.3.5.10 The Governmental Accounting Standards Board (GASB) Statement 84, Fiduciary Activities requires the following financial statements for fiduciary funds. [1]

- Statement of Fiduciary Net Position, and

- Statement of Changes in Fiduciary Net Position.

The fiduciary statements are to be prepared using the economic resources measurement focus and full accrual basis of accounting. [2]

Defined benefit pension and Other Post Employment Benefit (OPEB) plans

4.3.5.30 The GASB has issued Statement 67, Financial Reporting for Pension Plans and Statement 74, Financial Reporting for Postemployment Benefit Plans Other Than Pension Plans. These statements require that local governments administering defined benefit pension and OPEB plans through a qualifying trust report financial information on their plan assets, liabilities, net position and changes in net position using the statement of fiduciary net position, and statement of changes in fiduciary net position. These statements also require specific plan disclosures in the notes to the financial statements and required supplementary information that varies depending upon plan type. The plan note disclosures are discussed in notes to financial statements, and the required schedules are discussed in BARS Manual 4.7, Required Supplementary Information (RSI).

4.3.5.40 Only defined benefit pension and OPEB plans that are administered through qualifying trusts should present the statement of fiduciary net position and the statement of changes in fiduciary net position. A qualifying trust is one that meets all of the following criteria:

- Contributions from employers and nonemployer contributing entities to the plan and earnings on those contributions are irrevocable.

- Plan assets are dedicated to providing benefits to plan members in accordance with the benefit terms.

- Plan assets are legally protected from the creditors of employers, nonemployer contributing entities, the plan administrator, and plan members.

Plans that are not administered through trusts that meet the above criteria should not present either a statement of fiduciary net position or a statement of changes in fiduciary net position. In these cases, any assets accumulated for pension or OPEB purposes are required to be reported as assets of the employer. This means the activity in these funds must be rolled into another relevant fund (most often the general fund) for financial reporting purposes.

4.3.5.50 The reporting goal of the GASB statements is to assure that audited detail of each pension and OPEB plan is available to the public, regardless of whether a plan is administered through a qualifying trust or not. OPEB plan reporting can be accomplished using several methods, they are:

- Prepare a standalone financial report for pension and OPEB plans that are administered through qualifying trusts.

This reporting method requires preparing a standalone financial report containing fiduciary fund statements, notes and RSI. The fiduciary statements in a standalone report require a multi-column presentation when multiple pension and OPEB plans are administered. Detail is required at the plan level in the statements, notes and RSI.

- Present the pension and OPEB plans financial information within the administrator/employer’s financial report. When an audited standalone report is not publicly available, an employer participating in a pension or OPEB plan is responsible for reporting audited plan information. Employer reporting can be satisfied by:

- Contributions from employers and nonemployer contributing entities to the plan and earnings on those contributions are irrevocable.

- Plan assets are dedicated to providing benefits to plan members in accordance with the benefit terms.

- Plan assets are legally protected from the creditors of employers, nonemployer contributing entities, the plan administrator, and plan members.

- For plans administered through a qualifying trust, report the plans using the Pension and OPEB trust funds column of the fiduciary fund statements. When more than one pension and/or OPEB plan exists, individual plan statements are required to be presented in the notes to the financial statements.

- For plans that are not administered through a qualifying trust, fiduciary fund statements should not be presented.

- Regardless of the plan type (qualifying trust or non-qualifying trust), prepare the required note disclosures and RSI for each pension and/or OPEB plan.

- Report detail of pension and OPEB plans in an Annual Comprehensive Financial Report (ACFR).

When multiple pension and/or OPEB plans are administered by an employer through qualifying trusts, the details of financial reporting can be met by presentation of the plans as individual funds in the combining statements of an ACFR. The plan notes and RSI will be presented in the financial statement notes and in the RSI section following the notes.

External investment pools

4.3.5.53 An external investment pool is defined as:

“An arrangement that commingles (pools) the moneys of more than one legally separate entity and invests, on the participants’ behalf, in an investment portfolio; one or more of the participants is not part of the sponsor’s reporting entity (GASBS 31, paragraph 22).”

Governmental external investment pools are required to be reported in either an investment trust fund or external investment custodial fund that reports transactions and balances using the economic resources measurement focus and the accrual basis of accounting. If a separate financial report is issued for the pool, the financial statements of the sponsoring government should:

- Disclose how to obtain that report.

If a separate report is not issued, the sponsoring government’s financial statements should include, for each pool, the following disclosures:

- The frequency of determining the fair value of investments

- The method used to determine each participant’s shares sold and redeemed

- Condensed statements of fiduciary net position and the changes in fiduciary net position

- A brief description of any regulatory oversight for the pool

- Whether the fair value of the position in the pool is the same as the value of pool shares

- If participation is involuntary, this should be disclosed

- Any limitation or restriction on participant withdrawals – such as mandated notice periods, maximum transaction amounts, liquidity fees or redemption gates.

If the pool distributes investment income on an amortized cost basis, the notes must indicate that distributions are made on an amortized cost basis, which differs from a fair value basis, and that the difference between the two methods is reported in the net position section on the statement of fiduciary net position as undistributed and unrealized gains (losses).

The condensed statements of fiduciary net position and changes in fiduciary net position of the pool should include, in total, the net position held in trust for pool participants, and the equity of participants should distinguish between internal and external portions. If the government sponsors more than one external investment pool, the disclosures are required for each pool separately.

The external portion of investment pools that are not held in a trust or equivalent arrangement that meets the criteria of the GASBS 84 should be reported in a separate external investment pool fund column, under custodial funds classification.

Individual investment accounts

4.3.5.56 An individual investment account is separately managed by a government for legally separate entities which are not component units. Specific investments are acquired for the individual separate entities, and the income from and changes in the value of those investments affect only the separate entity for which they were acquired.

The GASBS 31 requires governments to report as separate investment trust funds the individual investments accounts. All individual investment accounts may be aggregated as a single investment trust fund and be presented as one column.

Private-Purpose Trust Funds

4.3.5.57 Private-purpose trust funds should be used to report all fiduciary activities that (1) are not required to be reported in pension (and other employee benefit) trust funds or investment trust funds and (2) are held in trust or an equivalent arrangement that meets the GASBS 84 criteria.

Custodial Funds

4.3.5.58 Custodial funds should be used to report fiduciary activities that are not required to be reported in pension (and other employee benefit), investment and private-purpose trust funds. The external portion of investment pools that are not held in a trust or an equivalent arrangement that meets the criteria of the GASBS 84 should be reported in a separate external investment pool fund column, under custodial funds classification.

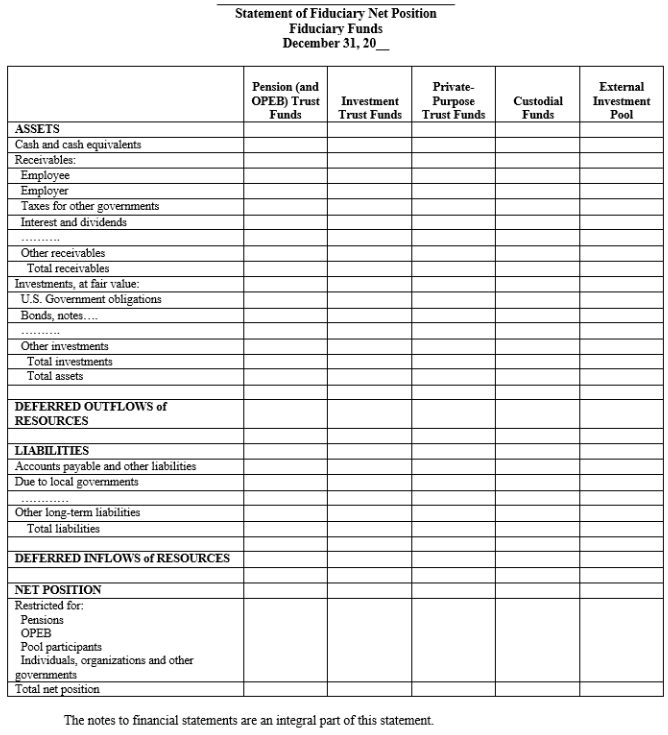

Statement of Fiduciary Net Position

4.3.5.60 This statement should include information about the assets, deferred outflows of resources, liabilities, deferred inflows of resources and fiduciary net position for each fiduciary fund type [3] and similar discretely presented component units of the government. The governments reporting a pension plan or an OPEB plan in the pension (and OPEB) trust fund should provide level of details for assets, deferred outflows, liabilities, deferred inflows and net position in accordance with GASB Statements 67 and 74.

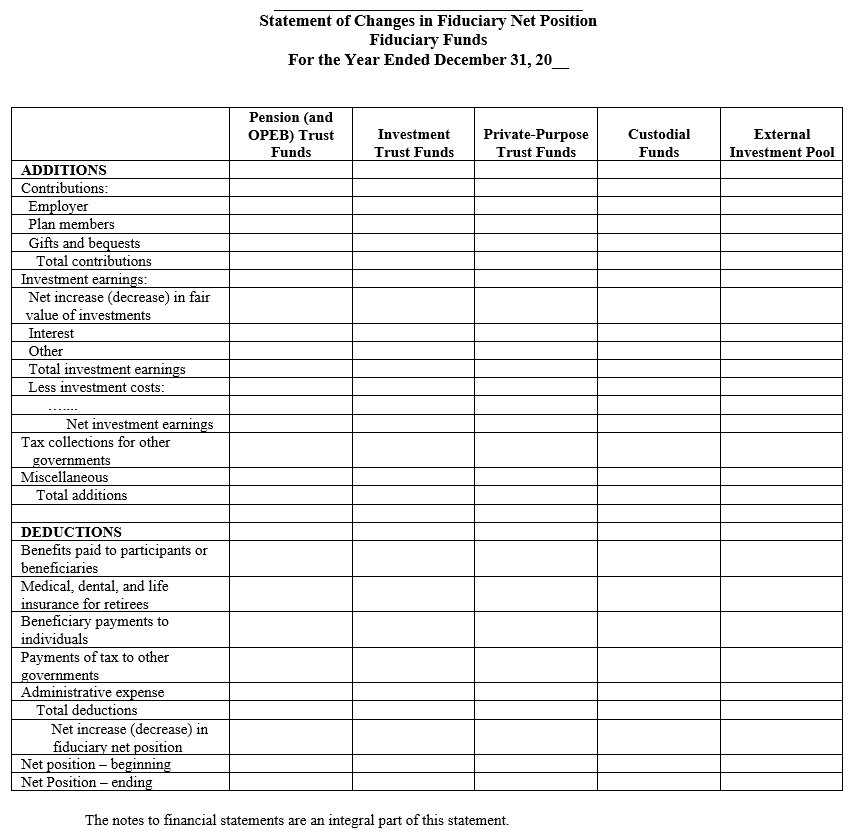

Statement of Changes in Fiduciary Net Position

4.3.5.70 The statement of changes in fiduciary net position should include information about the additions to, deductions from for each fiduciary fund type [4] and similar discretely presented component units. It should provide information about significant year-to-year changes in net position.

The governments reporting a pension plan or an OPEB plan in the pension (and OPEB) trust fund should report changes in plan’s fiduciary net position in accordance with GASB Statements 67 and 74.

The statement of changes in fiduciary net position should disaggregate additions by source including, if applicable, separate display of:

a. Investment earnings

b. Investment costs (including investment management fees, custodial fees, and all other significant investment-related costs)

c. Net investment earnings (investment earnings minus investment costs).

Deductions should be disaggregated by type and, if applicable, should separately display administrative costs.

If the resources in custodial funds, upon receipt, are normally expected to be held for three months or less, a government may report a single aggregated total for additions and deductions. The description of the aggregated totals should indicate the nature of the resource flows (e.g., property tax collected for other governments, etc.).

Footnotes

[1] Component units that are fiduciary in nature should be presented within the fund type columns with the fiduciary funds of the primary government. A separate column for fiduciary component units should not be presented.

Return to Reference 1

[2] There are some exceptions for liabilities of defined benefit pension plan and certain postemployment health care plans. Paragraph 20 of Statement 67 and paragraph 26 of Statement 74 provide guidance on recognition of these liabilities.

Return to Reference 2

[3] The major fund reporting does not apply to fiduciary funds.

Return to Reference 3

[4] The major fund reporting requirements do not apply to fiduciary funds.

Return to Reference 4