Note X – Derivative Instruments

A. Summary of Derivative Instruments

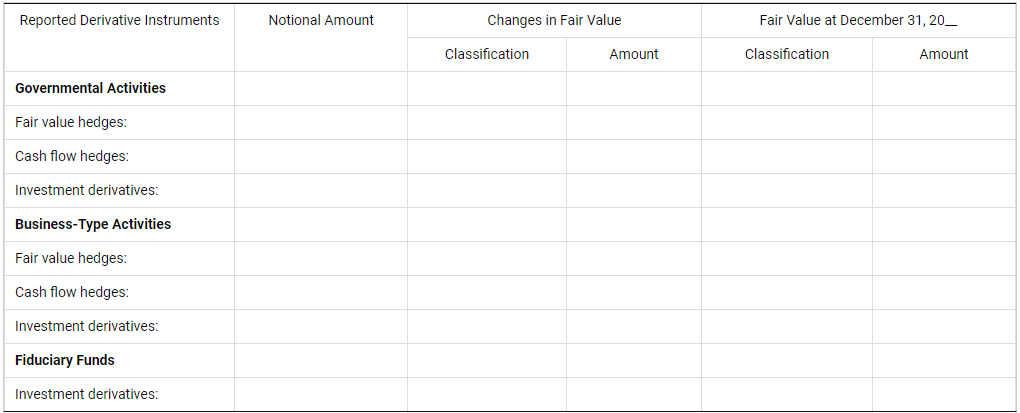

At December 31, 20__, the (city/county/district) had the following derivative instruments outstanding: [1]

B. Objective and Terms of Hedging Derivatives

The following table displays the objective and terms of the (city/county/district) hedging derivative instruments outstanding at December 31, 20__, along with the credit rating of the associated counter party. [2]

|

Type |

Objective |

Notional Amount |

Effective Date |

Maturity Date |

Terms |

Counter Party Rating |

C. Net Cash Flows of Derivatives Hedging Debt

The following table displays the (city/county/district) net cash flows of derivatives hedging debt:

|

Year Ending December 31 |

Principal |

Interest |

Hedging Derivatives, Net |

Total |

|

20__ |

||||

|

20__ |

||||

|

20__ |

||||

|

20__ |

||||

|

20__ |

||||

|

20__-20__ |

||||

|

20__-20__ |

||||

|

Total |

D. Hedging Derivative Risks [3]

E. Investment Derivative Risks [4]

F. Contingent Features [5]

Instructions to preparer:

Government Accounting Standards Board (GASB) Statement 53 requires the fair value of derivatives to be determined and reported on the appropriate statements of net position (government-wide and proprietary funds). The changes in fair value of investment derivatives should be reported within the investment revenue classification on the appropriate operating statements. Changes in fair value of hedging derivative instruments should be recognized using hedge accounting. This requires these changes be reported on the appropriate statement of net position as either deferred inflows or outflows, as long as the hedge is effective. When the hedging derivative contract ends or the hedge is determined to no longer be effective deferred amounts should be reported on the appropriate operating statements.

GASB Statement 53 also requires financial note disclosure for a government’s derivative instrument activity. The following section discusses these requirements for all derivative types. They include disclosures for hedging derivatives for cash flows and fair value and investment derivatives. Governments need only disclose those areas that are applicable to them. The disclosures are:

-

Summary of derivative instruments (narrative and table of fair values and changes in fair value)

-

Objectives and terms of hedging derivatives (including table of net cash flows, if the item being hedged is debt) and the risks related to hedging derivatives

-

Disclosures for investment derivatives

-

Contingent liabilities

Summary of derivative instruments:

Derivatives should be summarized and reported in their related activity: governmental-activities, business-type activities and fiduciary funds. Within each of those activities the derivatives will be categorized by type:

-

Fair value hedging derivatives

-

Cash flow hedging derivatives

-

Investment derivatives

Individual derivatives are not required to be displayed. They may be totaled by type and presented by type under the appropriate activities. The following information must be disclosed about each type contained in an activity. See the example derivative summary below.

Example summary disclosure for derivatives:

-

Notional amount – the amount of the underlying; stated in dollars, shares, gallons, etc.

-

Fair value – as of the date of the financial statements and the locations in the financial statements where it is reported.

-

Changes in fair value during the year – and the locations in the financial statements where the changes are reported.

-

The fair value of hedging derivatives that were reclassified as investment derivatives because they were no longer effective.

-

The amount of removed from deferred inflows and outflows in the statements of position and reported as investment income (because a derivative ended).

Footnotes:

[1] Objectives and Terms of Hedging Derivatives

Governments may aggregate information on hedging derivatives; however, if there are differences many may require individual disclosure. Required disclosures include:

-

An explanation of a government’s objective for entering into the hedging contract and how it plans to achieve its objective.

-

Significant terms of hedging derivative to be disclosed:

Notational amount

Indexed or interest rates it’s based on, including the impact that changes in the indexes or rates can have on the derivative

Options imbedded in the derivative

Starting and ending dates

The cash payment, if any, that was made when the derivative was initiated.

Example objectives and terms of hedging derivatives:

|

Type |

Objective |

Notional Amount |

Effective Date |

Maturity Date |

Terms |

Counter Party Rating |

|

Receive-fixed interest rate swaps |

Hedge of changes in FV of 20W7 bonds |

$30,000 |

9/30/W6 |

9/30/Z1 |

Receive 5%; pay 67% SOFR |

A/A |

|

Pay fixed interest rate swaps |

Hedge of changes in cash flows on 20W1 series F bonds |

$60,000 |

3/31/W1 |

3/31/Y6 |

Pay 5.4%; receive SIFMA index |

AAA/Aaa |

|

Pay fixed interest rate swaps |

Hedge of changes in cash flows on 20W8 series D bonds |

$24,000 |

2/28/W8 |

2/28/Y8 |

Pay 3.9%; receive 67% of SOFR |

AAA/Aaa |

|

Rate cap |

Rate cap on 20W8 bonds |

$10,000 |

7/31/W7 |

7/31/Y7 |

SIFMA swap index cap, 8% |

AA/Aa |

|

Commodity forward contract |

Hedge of cash flows due to market price fluctuation #2 home heating oil |

1,000 BTUs |

4/30/X0 |

12/31/X0 |

Pay $7.50 per MMBTU; Settlement based on Henry Hub pricing at expiration date |

AA/Aa |

|

Pay fixed interest rate swaps |

Hedge of changes in cash flows on 20X0 series D bonds |

$ 37,000 |

5/31/X0 |

5/31/Y0 |

Pay 3.2%; receive 67% of SOFR |

AAA/Aaa |

[2] If the item being hedged is debt, the government should disclose the net cash flow of the hedging derivative. This information is to be provided until maturity. The disclosure should present the following information for each of the next five years and then in five year increments until the end of the contract. Principal portion of debt payment, interest portion of payment, net cash flow for debt hedging derivatives, and total. See the example below.

Example Net Cash Flows of Derivative Hedging Debt Table:

|

Year Ending December 31 |

Principal |

Interest |

Hedging Derivatives, Net |

Total |

|

20__ |

$6,000 |

$7,786 |

$(1,253) |

$12,533 |

|

20__ |

10,000 |

7,525 |

(1,211) |

16,314 |

|

20__ |

27,000 |

7,090 |

(1,141) |

32,949 |

|

20__ |

33,000 |

5,916 |

(952) |

37,964 |

|

20__ |

15,000 |

4,480 |

(721) |

18,759 |

|

20__-20__ |

29,000 |

19,140 |

(3,080) |

45,060 |

|

20__-20__ |

15,000 |

12,385 |

1,475 |

28,860 |

|

20__-20__ |

14,000 |

9,570 |

(528) |

23,042 |

|

20__-20__ |

30,000 |

6,310 |

(300) |

36,010 |

|

Total |

$179,000 |

$80,202 |

$(7,711) |

$251,491 |

[3] Disclosures for Hedging Derivative Risks

Entities need to present disclosure of the risks for the hedging derivatives which the government is exposed.

-

Termination risk – a government needs to disclose any termination that occurred during the fiscal period, dates that its remaining derivatives may be terminated, and unusual conditions for termination.

-

Credit risk – If a derivative exposes it to credit risk, report:

The credit quality of the firm

The maximum potential loss if the firm fails to fulfill it obligations

The collateral or other security supporting the derivatives

Significant concentrations of credit risk with a particular firm or group of firms

-

Interest rate risk – describes the terms that increase the government’s exposure to interest rate risk.

-

Basis risk – disclose the derivatives payment terms and terms of the associated debt.

-

Rollover risk – disclose the maturity of the derivative and the subsequent maturity date of the associated debt.

-

Market access risk – potential to the risk of being unable to borrow in the future.

-

Foreign currency risk – disclose the U.S. dollar balances of derivatives that expose the government to this risk.

[4] Disclosures for Investment Derivatives Risks

For derivatives that are investments, governments should disclose the credit risk information that could give rise to financial loss. Risk disclosures are limited to investment derivatives that are reported as of yearend.

[5] Contingent Features

Governments should disclose obligations to post collateral if the credit quality of the hedgeable item declines. They should report:

-

The existence and nature of contingent features and circumstances which could trigger the features.

-

The aggregate fair value of the derivatives with those features.

-

The aggregate fair value of assets that would be required to be posted as collateral or transferred

-

The amount, if any, that has been posted or transferred during the period.

Hybrid Instruments

Hybrid instruments are a derivative instrument that has a companion instrument. If a government reports a hybrid instrument disclosures of the companion instrument should be consistent with disclosures required of similar transactions.

Synthetic Guaranteed Investment Contracts

Governments that report a synthetic guaranteed investment contract that is fully benefit responsive should disclose the following information.

-

description of the nature of the SGIC,

-

the SGIC’s fair value.