4 Reporting

4.7 Required Supplementary Information (RSI)

4.7.2 Budgetary Comparisons

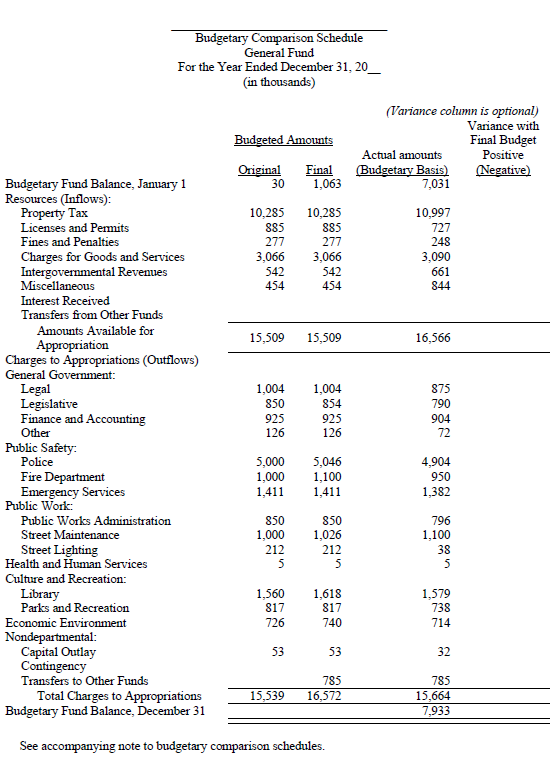

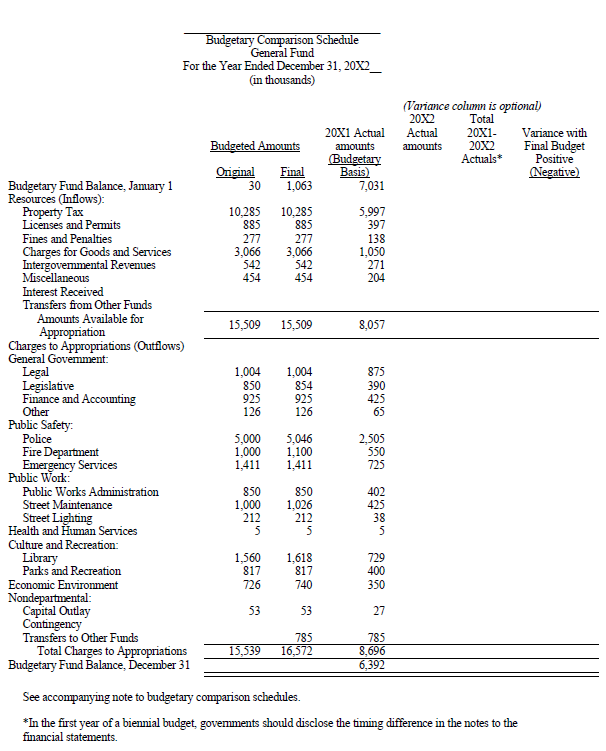

4.7.2.10 The budgetary comparison is required to be presented either as a statement in the basic financial statements or as a schedule in the RSI. Budgetary comparisons are required for the general fund and for each major special revenue fund [1] that has a legally adopted budget. The format and content of the budgetary comparisons are the same for either presentation.

4.7.2.20 The budgetary comparison schedules should provide at least three separate types of information.

- The original budget – the first complete legally appropriated budget adjusted for changes occurring before the beginning of fiscal year. The original budget should also include actual appropriation amounts automatically carried over from prior years by law.

- The final budget – including all legally authorized changes including those occurring during and after the end of fiscal year.

- Actual inflows, outflows and balances – should be reported on the same basis as the legally adopted budget.

4.7.2.30 Notes to the RSI should disclose an explanation of the excesses of expenditures over appropriations in individual funds presented in the budgetary comparison. If budgetary comparison information is included in the basic statements, these disclosures should be in the notes to the financial statements, rather than as notes to the RSI. If the excess of expenditures over appropriations is considered a material violation of legal provisions, the disclosure should be made in the notes to financial statements.

4.7.2.40 Governments may present the budgetary comparison schedule using the same format, terminology, and classification as the budget document, or using the format, terminology, and classifications in a statement of revenues, expenditures, and changes in fund balances. Comparison schedules should be reported at the same level of detail as the adopted budget. (i.e. if the government adopts their budget to the level of salaries/wages, benefits, services, etc., the budget to actual comparison is presented at the same level). Biennial budgets should be reported at the same level of detail as the adopted budget (i.e. if the government adopts their budget presenting two individual budget years or as one single biennial budget, the budget to actual comparison is presented the same). Regardless of the format used, the schedule should be accompanied by information (either in a separate schedule or in notes to the RSI) that reconciles budgetary information to GAAP information.

4.7.2.50 Governments with budgetary perspective differences [2] that result in the government not being able to present budgetary comparisons for the general fund and each major special revenue fund are required to present budgetary comparison schedules as RSI based on the fund, organization or program structure that the government uses for its legally adopted budget [3].

Governments with timing differences that result in significant variances between budgetary practices and GAAP including: continuing appropriations, project appropriations, automatic appropriations and biennial budgeting. Governments that adopt budgets with timing differences should disclose the cause for the significant variance(s) in the notes to the financial statements.

Governments with significant perspective differences, such as sub funds of the general fund must: (1) present budgetary comparison, (2) format the budgetary comparison using the budgetary framework, and (3) present the budgetary comparison as RSI rather than as a basic financial statement.

Annual Budget (single year) presentation

Biennial Budget presentation

Footnotes:

[1] All major special revenue funds, whether designated as major based on the percentage criteria or management's discretion, are subject to this requirement.

[2] The perspective difference may be related to special revenue funds which have their own legally approved budgets, but which do not qualify as special revenue funds per GASB Statement 54 and are included in the general fund for external reporting purposes.

[3] GASB Statement 41, Budgetary Comparison Schedule – Perspective Differences.