4 Reporting

4.7 Required Supplementary Information (RSI)

4.7.5 Revenue and Claims Development Trend Data (for Public Entity Risk Pools) [1]

4.7.5.10 The following information is provided as an example of the required supplementary information (RSI) that is expected for public entity risk pools. Be sure to revise these sample documents to fit the unique circumstances of the pool, to delete disclosures that do not apply to the pool’s operations, and to add others that we did not include but which are needed to help a reader understand the financial statements.

4.7.5.20 The following revenue and claims development information should be included as required supplementary information immediately after the notes to financial statements in the pool’s financial reports for each of the past ten fiscal years including the latest fiscal year, new risk pools will build the table prospectively.

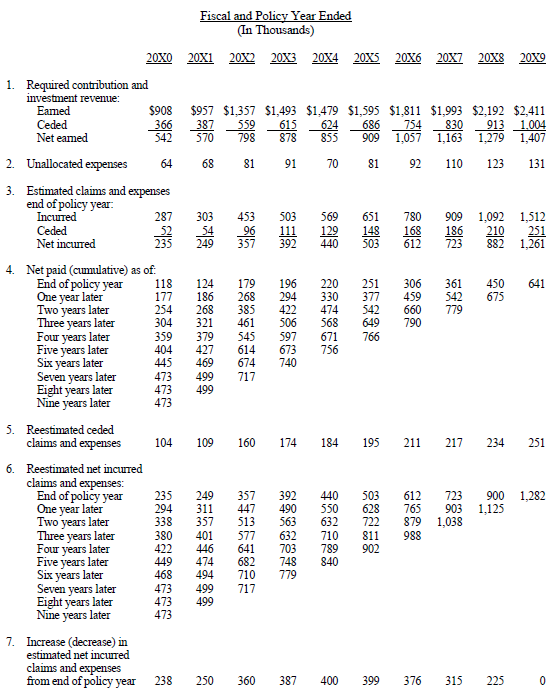

1. Ten-Year Claims Development Information

The table below illustrates how the pool’s earned revenues (net of reinsurance) and investment income compare to related costs of loss (net of loss assumed by reinsurers) and other expenses assumed by the pool as of the end of each of the last ten years. The rows of the table are defined as follows:

(1) This line shows the total of each fiscal year gross earned contribution revenue and investment revenue, contribution revenue ceded to reinsurers, and net earned contribution revenue and reported investment revenue.

(2) This line shows each fiscal year’s other operating costs of the pool including overhead and claims expense not allocable to individual claims.

(3) This line shows the pool’s gross incurred claims and allocated claim adjustment expenses, claims assumed by reinsurers, and net incurred claims and allocated adjustment expenses (both paid and accrued) as originally reported at the end of the first year in which the event that triggered coverage under the contract occurred (called policy year).

(4) This section of ten rows shows the cumulative net amounts paid as of the end of successive years for each policy year.

(5) This line shows the latest reestimated amount of claims assumed by reinsurers as of the end of the current year for each accident year.

(6) This section of ten rows shows how each policy year’s net incurred claims increased or decreased as of the end of successive years. (This annual reestimation results from new information received on known claims, reevaluation of existing information on known claims, as well as emergence of new claims not previously known.)

(7) This line compares the latest reestimated net incurred claims amount to the amount originally established (line 3) and shows whether this latest estimate of net claims cost is greater or less than originally thought. As data for individual policy years mature, the correlation between original estimates and reestimated amounts is commonly used to

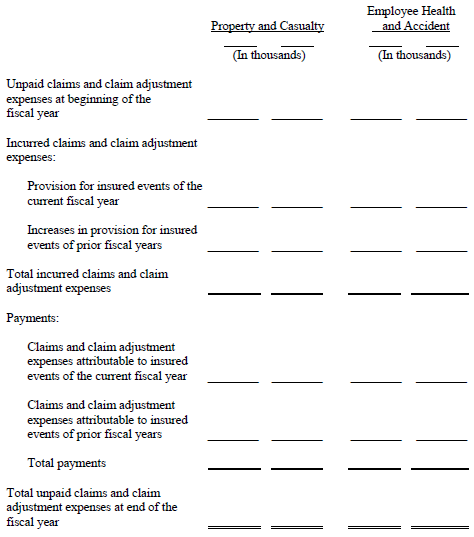

2. Reconciliation of Claims Liabilities by Type of Contract

The schedule below presents the changes in claims liabilities for the past two years for the pool's two types of contracts: property and casualty and employee health and accident benefits.

Footnotes:

[1] See the GASB Statement 10, Accounting and Financial Reporting for Risk Financing and Related Insurance Issues, Statement 30, Risk Financing Omnibus and Statement 31, Accounting and Financial Reporting for Certain Investments and for External Investment Pools.